Asian Oil Imports and the Crude Tanker Market

With Iran’s oil exports under immense pressure, it’s worth taking a look at how Asian countries, like Japan and South Korea, are finding ways around the problem and how this is affecting the tanker market. In terms of Japan’s crude oil market, Banchero Costa said in a recent weekly analysis that “Japan is a global leading importer of crude oil because of its minimal domestic crude production. Japanese crude oil imports peaked around 202 million tonnes in 2008 before stabilizing just below 180 million tonnes in the following 5 years, while between 2014 and 2017 imports averaged 165 million tonnes. In 2018, imports decreased by 5 percent to around 150 million tonnes, according to data released by the Ministry of Economy, Trade and Industry (METI). The year-end stats from METI show that as much as 88 percent of imports were sourced from the Middle East, with Saudi Arabia ranking as the top supplier with around 57.4 million tonnes (equivalent to 38 percent of total imports), followed by the UAE and Qatar, which accounted for 25 percent (38.3 million tonnes) and 8 percent (12.2 million tonnes) respectively, and then by Kuwait (11.5 million tonnes – 8 percent), Russia (6.7 million tonnes – 4 percent) and Iran (6.3 million tonnes – 4 percent). During the same year, the US re-imposed sanctions against Iran from November 2018 and granted 6 months waivers to the eight largest buyers of Iranian crude oil (including Japan, China, India, South Korea, Taiwan, Italy, Greece and Turkey), which expired in May 2019”, said the shipbroker.

It added that “consequently, Japan’s crude oil imports from Iran were suspended from November 2018 to January 2019 and then halted from May 2019. In order to compensate the sour light and affordable Iranian grade, Japan has increased its crude oil imports from other countries including the UAE, Russia and the US. In the first five months of 2019, Japanese crude oil imports totaled 63.8 million tonnes, with imports from Saudi Arabia and the UAE reaching around 23.9 million tonnes and 16.7 million respectively, followed by Qatar and Kuwait (around 5.3 million tonnes each), Russia (3 million tonnes) and the US (1.6 million tonnes). In May 2019 Japan’s crude oil imports rose 2 percent m-o-m to 12.75 million tonnes. In the same month, the UAE ranked first in the list of Japanese crude oil supplier thanks to 4.3 million tonnes (+48 percent m-o-m and +66 percent y-o-y), by surpassing Saudi Arabia which exports to Japan totaled 4.13 million tonnes (-5 percent m-o-m and -13 percent y-o-y). In May 2019, imports from the US were roughly 32-times those of May 2018, according to METI”, Banchero Costa concluded.

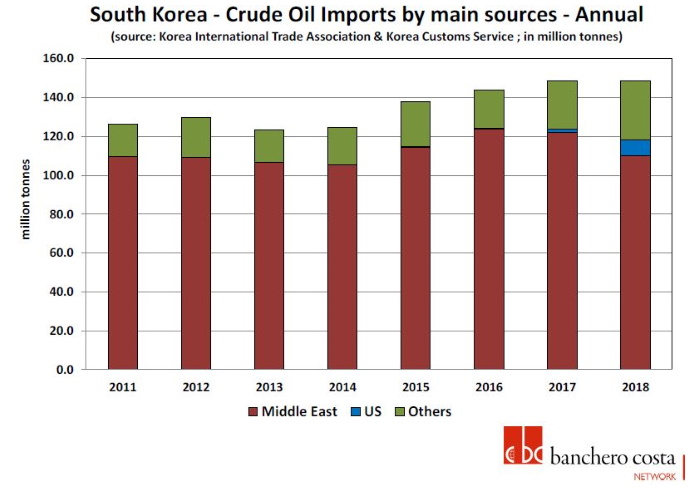

Similarly, “South Korea is one of the largest consumer of oil in the world, relying almost exclusively on abroad imports as a result of its minimal production. According to Korean Customs Service, South Korean crude oil imports rose by 10.6% in 2015 to 137.8 million tonnes before reaching 143.9 million tonnes in 2016 (+4.4% year-over-year) and peaking at 148.7 million tonnes in 2017. In 2018 imports totaled 148.6 million tonnes of which 29% was sourced from Saudi Arabia that came first before Kuwait and Iraq, which accounted for an additional 15% and 13% respectively. South Korea has always depended heavily on imports from Middle Eastern countries, to such an extent that starting from 2014 the government, in order to ease this reliance, granted freight incentives to South Korean oil refiners buying crude oil from other regions than Middle East”, said Banchero Costa.

The shipbroker also noted that “Washington’s decision to re-impose sanctions against Iran from November 2018 had a huge impact on South Korean crude oil supply patterns. Nevertheless, as one of the 8 major Iranian crude oil buyers, South Korea has benefited from a 180 days waiver to keep on buying crude from Iran until May 2019. As a result, imports from Iran were suspended between September and December 2018 and resumed during the first 4 months of 2019 before being halted from May 2019. In 2018, total crude oil imports from Iran dropped by 60% to 7.1 million tonnes. If freight incentives were originally due to last until the end of 2018, following the end of US sanctions waivers they were extended for further 3 years. In order to compensate the loss of Iranian barrels, South Korea has increased crude oil imports from other sources including UK, Kazakhstan, West Africa and especially US. In 2018, following also the Sino-American trade war, South Korea surpassed China to become the largest destination of US crude oil seaborne exports. Last year imports from the United States, which typically involve VLCC via Cape of Good Hope, grew 343% y-o-y to around 7.9 million tonnes; that boosts ton x mile demand with a 15,000 nautical miles journey compared to around 6,200 nautical miles one from Iran. Compared to the same period in 2018, in the first half of 2019 South Korean crude oil imports decreased by 2%, imports from Middle Eastern countries fell by 12%, while imports from the US rise by an impressive 327%”, Banchero Costa concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software