ECB reserve tiering: what’s the impact on euro money markets?

Abundant excess liquidity will become very expensive for the ECB

As things stand, the ECB is set to pay an increasing amount of interest to banks on the nearly €4.6tr of excess liquidity (EL) outstanding in the banking system. At current deposit rates, this means €34.5bn per year, and if rates reach the 2.5% peak implied by the swap curve in 2023, this would amount to €115bn. Whilst this is sure to be portrayed, unfairly, in some corners as a subsidy to banks, this is not necessarily a problem insofar as banks’ financing costs are also increasing. The problem is that a large part of this excess liquidity was provided by the ECB in past targeted longer-term refinancing operations (TLTRO) loans to banks, with a lower average interest rate.

As a result, the ECB is now expected to introduce a tiered remuneration for EL. There is a precedent. In 2019, it shielded part of banks’ excess reserves held at the ECB (which are part of EL alongside deposits placed at the ECB) from negative interest rates. Back then, the goal was to prevent a collapse in banks’ profitability; this time around, the aim is the opposite, but the practice of micro-managing banks’ profitability is the same.

Potential designs

The form tiering of EL takes depends on the ECB’s goals.

1. If the aim is simply to offset the benefit offered through TLTROs and to incentivise banks to repay the existing balance, then remunerating a proportion of EL proportional to TLTRO balances at 0% is the way to go.

2. If, on the other hand, the ECB is digging in for a long period of high-interest rates, and high excess liquidity (the remaining portion is explained by the size of its bond portfolio, which will take a lot longer to unwind than TLTRO balances) then it may opt to remunerate at 0% either: a) A multiple of banks’ required reserves. This is what it did in 2019, with the multiple set at 6x or b) A proportion of banks’ EL. For instance, calculated as an average balance over a certain period.

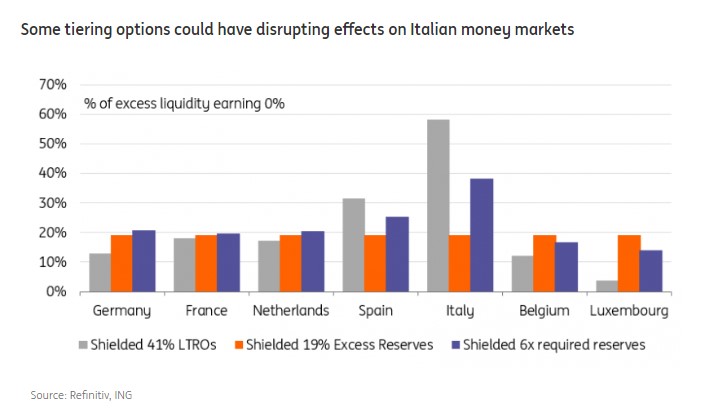

In the example below, we calibrate the threshold calculated for each method so to the total amount of EL earning 0% at the eurozone level is the same as for a 6x multiple of required reserves, currently around €960bn.

In effect, option one is more targeted and limited in time to the maturity of existing TLTRO facilities with the latest due to be repaid in 2024. We surmise this would be an effective way to force TLTRO repayments, but there is a simpler way to achieve this: change TLTRO terms. This is also the option that would cause the most disruptions. For instance, Italian banks would see a greater proportion of their EL earning 0%.

Within the two sub-options a) would make the size of EL earning 0% proportional to a bank’s balance sheet, which is not ideal in cases where reserve requirements are not proportional to the EL deposited at the ECB. Similarly to option one above, Italian banks would see a greater portion of their EL earning 0%. Sub-option b) on the other hand would make sure that all banks see the same proportion of their EL remunerated at 0% and at the deposit rate.

The impact on EUR rates and money markets will depend on how the tiering system is structured. We’re assuming that in all cases the amount remunerated at 0% will be fixed (according to one of the methods described above) and that any EL above that threshold will earn the deposit rate. In practice, however, tiering will lower the average rate earned by banks on their EL. It is also possible that for some banks, 0% becomes the marginal interest rate if their EL is below the threshold.

An alternative design would be to remunerate at the deposit rates EL until a certain threshold. If that threshold is high enough, it would act as an incentive to repay TLTRO without causing a fall in money market rates.

The higher the threshold, the greater the disruptions

The most important factor is thus how many banks will find themselves with EL at the ECB below or close to the threshold. In a ‘prudent’ scenario, tiering is designed so that the vast majority of banks find themselves with EL balances well above the threshold. This, however, would only partially reduce the ECB’s interest rate bill. In a more aggressive case, a high threshold means many banks would find that they are earning 0% on all of their EL balance, thus creating an incentive to reduce them by any economical means possible.

Irrespective of how it is calculated, the ECB can set the tiering threshold at three levels.

1 High threshold (above €2.5tr of EL earning 0%)

At the eurozone level, if the threshold is set so high that more banks have EL below the threshold than above, we would expect a collapse in money market rates as banks rush to lend their cash and disincentivise depositors from parking cash at their branches. This makes this option unlikely as it would amount to a net easing of financial conditions, which is contrary to the ECB’s goal. Even if EL currently stands at €4.6tr, TLTRO repayments could make that figure shrink over the next two years to closer to €2.5bn.

2 Balanced threshold (€1.5-2tr)

In a more likely scenario where, at the eurozone level, a majority of banks have EL above the tiering threshold, then the main focus should be on country differences. It may well be that some countries find themselves net lenders of reserves (if they are below the threshold and so earn 0% on all their balances) and others net borrowers (if they are above and so earn the deposit rate on any additional reserves). This would mean a fall in effective interest rates in some countries, for example, Italy and Spain, and a rise in others, for instance, Belgium and Luxembourg. This should be reflected primarily in the fall in repo rates in net lender countries if their domestic banks own a large amount of government debt, but also in a relative fall in deposit rates. If, as we expect, the net lender banks are in Italy and Spain, this could go some way towards helping sovereign spreads tighten but could also disrupt the functioning of the repo market.

On the whole, we are unsure if this benefit would offset the operational problems caused to banks. The impact on net borrower countries should be less marked as we assume the marginal deposit rate for domestic banks wouldn’t be altogether different from the prevailing deposit and repo rates. Interestingly, the effect could be to ease financial conditions, on a relative basis, in peripheral countries.

3 Low threshold (below €1.5tr)

In the case where the vast majority of banks have EL well above the threshold, including within each country, then we expect the risk of a rush to lend out liquidity less likely. This scenario is the most probable in our view as it would result in less money market disruption but would also mean a lower reduction in the ECB’s interest rate payments to banks.

Depending on how it is calculated, especially if as a multiple of required reserves, then a fall in EL would also bring more banks closer to the threshold. This would imply reducing the multiple over time.

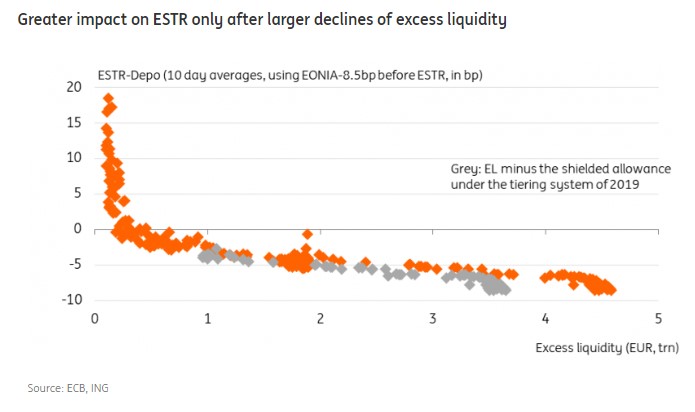

Greater impact on ESTR only after larger declines of excess liquidity

Money market rates and excess liquidity

The overnight rate (ESTR) which is the ECB’s starting point to assess whether its key rates are properly transmitted was pushed below the deposit facility rate when large excess reserves became a feature of the ECB’s policy implementation. Historical relationships between the level of overnight rates and the level of excess reserves suggest that the average rate will only very slowly rise from its depo floor as excess liquidity melts away (by about 1.5bp per €1tr reduction) and take off at an accelerated speed when levels drop below €500bn. At €4.6tr, that seems far away, but also keep in mind the Fed’s experience that the market’s plumbing has changed in such a way that these levels have likely shifted higher.

The most recent push lower in overnight rates and more significantly also longer unsecured rates such as the 3m Euribor fixing came with the large liquidity injections of the TLTROs amid the pandemic. To the degree that they have changed the short-term funding mix of banks affecting the fixing, repayment of these operations could see this effect unwind again. It is one reason why the impact on overnight rates could already occur at still overall higher levels of excess liquidity than past experience would suggest.

Source: ING

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software