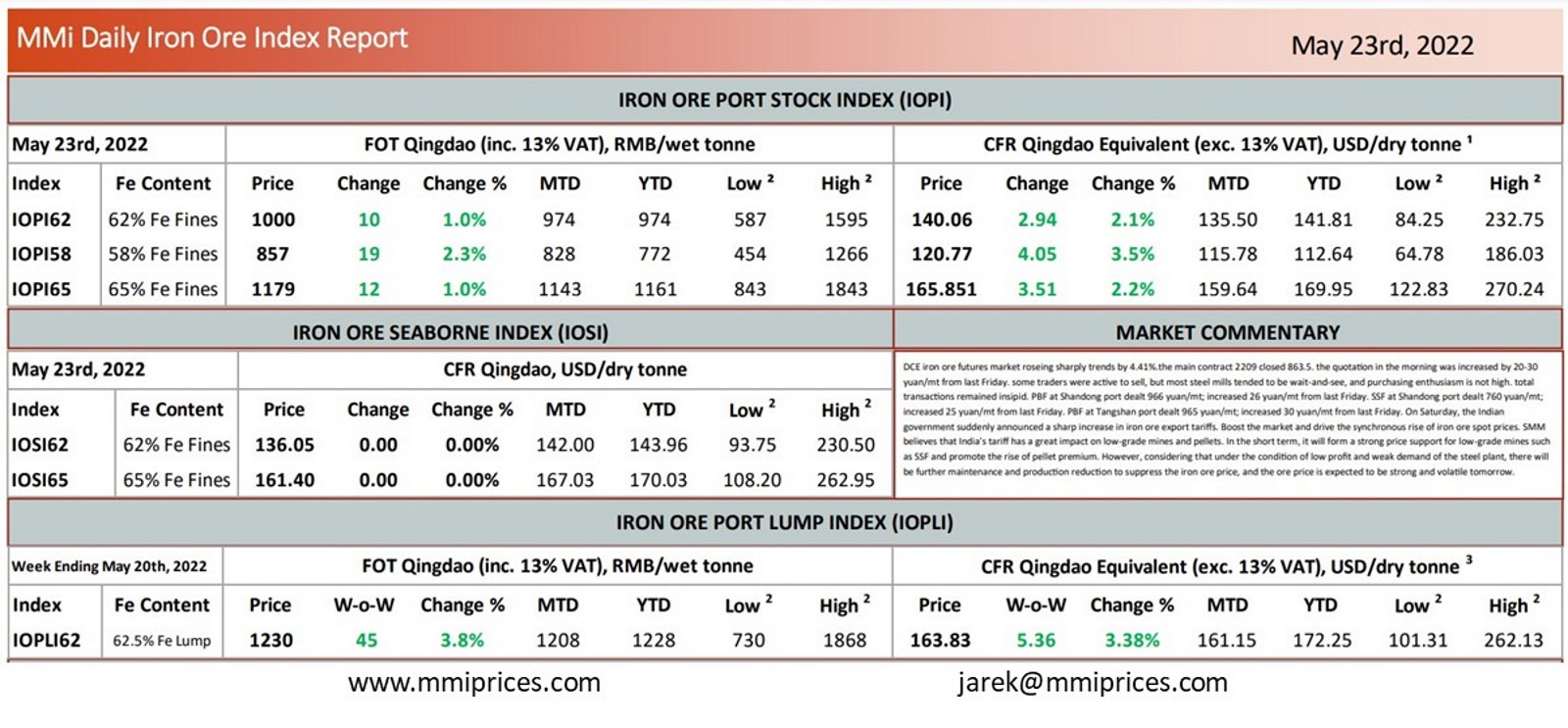

MMi Daily Iron Ore Index Report May 23 2022

DCE iron ore futures market roseing sharply trends by 4.41%.the main contract 2209 closed 863.5. the quotation in the morning was increased by 20-30 yuan/mt from last Friday. some traders were active to sell, but most steel mills tended to be wait-and-see, and purchasing enthusiasm is not high. total transactions remained insipid. PBF at Shandong port dealt 966 yuan/mt; increased 26 yuan/mt from last Friday. SSF at Shandong port dealt 760 yuan/mt; increased 25 yuan/mt from last Friday. PBF at Tangshan port dealt 965 yuan/mt; increased 30 yuan/mt from last Friday. On Saturday, the Indian government suddenly announced a sharp increase in iron ore export tariffs. Boost the market and drive the synchronous rise of iron ore spot prices. SMM believes that India’s tariff has a great impact on low-grade mines and pellets. In the short term, it will form a strong price support for low-grade mines such as SSF and promote the rise of pellet premium. However, considering that under the condition of low profit and weak demand of the steel plant, there will be further maintenance and production reduction to suppress the iron ore price, and the ore price is expected to be strong and volatile tomorrow.

Source: Metals Market Index (MMi)

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software