Newbuilding Activity Higher in 2021

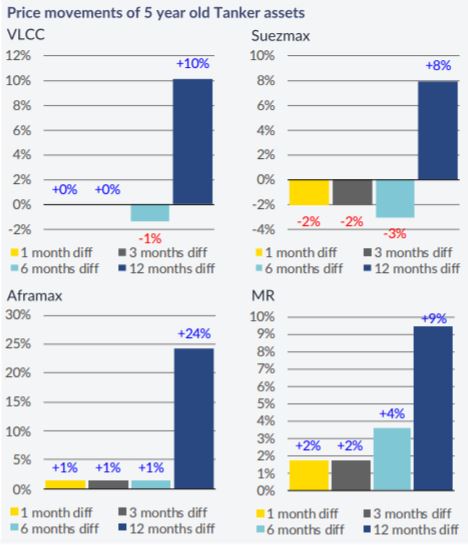

The newbuilding market, especially for bulkers and containers has been much more active during 2021. However, the end of the year has seen a decline in activity. In its latest weekly report, shipbroker Allied Shipbroking said that “activity in the newbuilding market was unimpressive during this past week, as the Christmas holidays trimmed potential for new deals to take shape. However, two fresh orders in the dry bulk market were seen, reflecting the robust sentiment in the sector that has been witnessed throughout the whole of the year. 2021 has been a remarkable year for the dry bulk market with record high freight earnings being noted and strong activity seen in the secondhand market compared to previous years. In the newbuilding front, it was also a much improved year with several deals emerging during the past months, nourished by the positive momentum and the healthy outlook. However, considering the new highs noted in the freight market, activity remained at rational levels, a fact that could give a fresh boost in the market over the coming years. In contrast to the dry bulk market, interest for tanker new ordering has been limited this year. Severely hurt sentiment as part of a never emerging rebound in earnings has capped interest amongst potential buyers. At the same time, increases in newbuilding prices have further trimmed interest for new projects”.

The newbuilding market, especially for bulkers and containers has been much more active during 2021. However, the end of the year has seen a decline in activity. In its latest weekly report, shipbroker Allied Shipbroking said that “activity in the newbuilding market was unimpressive during this past week, as the Christmas holidays trimmed potential for new deals to take shape. However, two fresh orders in the dry bulk market were seen, reflecting the robust sentiment in the sector that has been witnessed throughout the whole of the year. 2021 has been a remarkable year for the dry bulk market with record high freight earnings being noted and strong activity seen in the secondhand market compared to previous years. In the newbuilding front, it was also a much improved year with several deals emerging during the past months, nourished by the positive momentum and the healthy outlook. However, considering the new highs noted in the freight market, activity remained at rational levels, a fact that could give a fresh boost in the market over the coming years. In contrast to the dry bulk market, interest for tanker new ordering has been limited this year. Severely hurt sentiment as part of a never emerging rebound in earnings has capped interest amongst potential buyers. At the same time, increases in newbuilding prices have further trimmed interest for new projects”.

In a separate note, Clarkson Platou Hellas added that “in dry bulk this week, CMB ordered a further two firm 210k dwt Newcastlemaxes at CSSC Beihai. The vessels are reported to have an Ammonia ready notation and bring their current series to eight Vessels at the yard, with these two Vessels set to be delivered within 2H 2024. Huaxia Financial Leasing ordered two firm 64k dwt Ultramaxes at Nantong COSCO (NACKs), with delivery expected within 2023.

Huaxia Financial Leasing also declared options for four 63.5k dwt Ultramaxes at Chengxi, with delivery of the vessels set for 2024. In Containers, it was reported that TS Lines ordered a further two 7,000 TEU Containerships at Shanghai Waigaoqiao. The order brings their series at the yard to six, with deliveries expected within 4Q 2024. In the ferry market, Grandi Navi Veloci (GNV) reportedly ordered two firm 1,500 passenger, 3,100LM RoPaxes at GSI Nansha, with delivery of the vessels slated for 2024”, the shipbroker said.

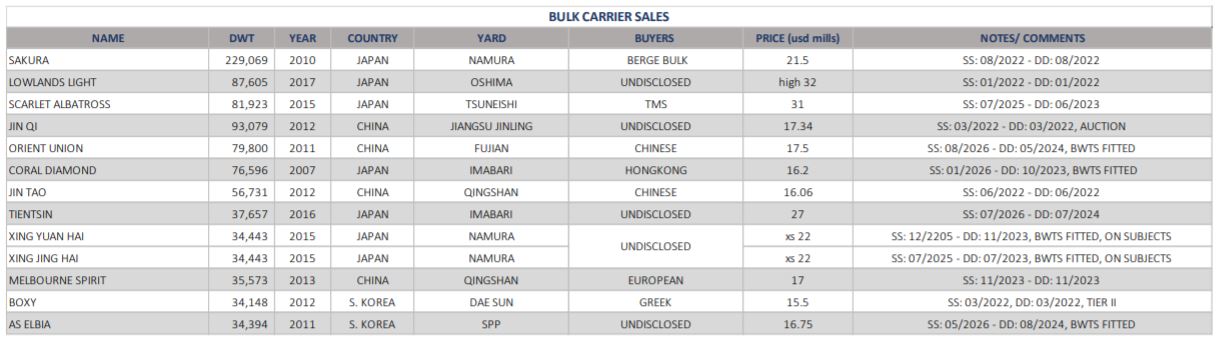

Meanwhile, in the S&P market this week, Xclusiv Shipbrokers noted that “on the dry S&P, the VLOC “Sakura” – 229K/2010 Namura was reported sold to clients of Berge Bulk for USD 21.5mil.Cobelfret are said to have sold their Post Panamax “Lowlands Light” – 88K/2017 Oshima for high 32’s while TMS acquired the “Scarlet Albatross” 82K/2015 Tsuneishi for USD 31mil. A number of modern Handies were sold this week, with two noteworthy sales being the “Xing Yuan Hai” – 34K/2015 Namura and sister “Xing Jing Hai – 34K/2015 Namura xs 22mil each. On the Tanker sale and purchase, notable this week is the “Astra”–149K/2002 Sasebo sold for mid USD 13mil, while the MR Tankers the “Dong A Triton” – 50K/2015 HMD, “Dong A Krios” – 50K/2015 HMD and “Dong A Themis” – 50K/2015 HMD are sold to clients of Tufton for USD 90mils enbloc”, the shipbroker concluded.

Allied added that “on the dry bulk side, a rather uninspiring week for the SnP market was due, given the relatively mediocre number of units changing hands during the past few days or so. This came hardly as a surprise, especially when thinking about the fact that we are amidst the typical Christmas holiday lull and the market has already eased back to a more sluggish mood. All-in-all, given the general sentiment and prolonged robust buying appetite in the SnP market, we expect things to return to a much stronger trajectory in the near term. On the tanker side, it was also a relatively quiet week, with the number of transactions remaining rather limited for now.

Hopefully, this is but a mere reflection of the typical lull noted in the market during the holiday period, rather than a hefty reversal from recent trends. Moreover, as mentioned in earlier market views, a fair amount will depend on developments from the side of earnings, whether we are about to see a more “sustainable” tone for the coming period”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software