Newbuilding Market Still Underwhelming

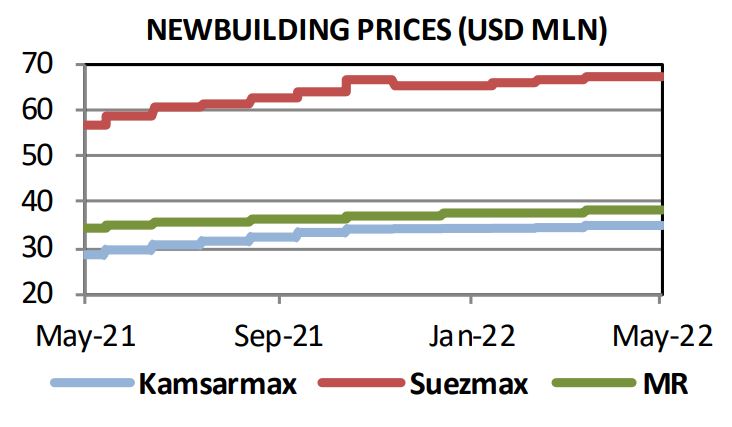

The newbuilding market remained rather underwhelming during the past week. In its latest weekly report, shipbroker Allied Shipbroking said that “activity in the Newbuilding market continues to move at a slow pace, while the prime sectors moving things forward continue to be the Gas and Container sectors. The difference observed this week compared to the previous one is the resurgence of buying interest in containership units, marking two orders at 4 and 6 units respectively. The interesting point is that most of this week’s new orders have been secured by South Korean shipyards, likely as a result of the disruptions that were still being observed last week at Chinese shipbuilders as part of the lockdown measures in China. With all this positive momentum still being noted. Given the positive performance being noted across most of the main shipping sectors, buyers’ interest remains firm, while the ample activity noted up to date has helped book a fair amount of available capacity given shipbuilders further confidence and negotiating power to pass off the increasing construction costs over to any new potential buyers. As such the expectation is for further price hikes to be noted in the near-term, despite the fact that we are already seeing prices hold at relatively high levels”.

The newbuilding market remained rather underwhelming during the past week. In its latest weekly report, shipbroker Allied Shipbroking said that “activity in the Newbuilding market continues to move at a slow pace, while the prime sectors moving things forward continue to be the Gas and Container sectors. The difference observed this week compared to the previous one is the resurgence of buying interest in containership units, marking two orders at 4 and 6 units respectively. The interesting point is that most of this week’s new orders have been secured by South Korean shipyards, likely as a result of the disruptions that were still being observed last week at Chinese shipbuilders as part of the lockdown measures in China. With all this positive momentum still being noted. Given the positive performance being noted across most of the main shipping sectors, buyers’ interest remains firm, while the ample activity noted up to date has helped book a fair amount of available capacity given shipbuilders further confidence and negotiating power to pass off the increasing construction costs over to any new potential buyers. As such the expectation is for further price hikes to be noted in the near-term, despite the fact that we are already seeing prices hold at relatively high levels”.

In a separate note, shipbroker Banchero Costa added that “active NB market in different sectors, lacking only tankers in today’s edition. The most relevant orders are again registered in the gas sector, with a major project of Petronas who is seeking up to 15 VLGC’s to operate under long term charter. Few yards in Asia have been selected and Owners in the sector to order and charter on long period to Petronas. HHI and Hyundai Samho are taking part and sharing each two ships, Samsung is following with five firm vessels. The prices are ranging between $223 and $227 mln for standard 174,000 cbm for delivery beginning of 2026. Apart from gas, the container market continues to pile up the orderbook especially in the feeder segment. CMA CGM signed an LOI with Hyundai for up to 8 x 8000 teu priced at around $120 mln each with deliveries from Q1 2025.

Euroseas declared options of an existing order, for 2 x 2800 teu priced at region $43 mln, for delivery Q4 2024. We hearing of some new interesting orders placed in the drybulk sector. Stock listed Globus Maritime ordered 2 ultramax at NACKS for dely Q4 2024 for $35.15 mln each; another important name Meadway Shipping and Trading selected Namura (at their Hakodate facilities) for the construction of 2 x 40,000 dwt handies, contracted at low $32 mln each for dely in mid 2024. Still in the handy, traditional Japanese owners Nisshin Kaiun selected Jiangmen Nanyang for as much as 6 x 39,000 dwt handy BC; no price nor deliveries emerged yet”.

Meanwhile, in the S&P market this past week, Allied noted that “on the dry bulk side, SnP activity was kept at decent levels, with buying appetite focusing on the smaller size segments despite the performance noted in the freight market this past week. On the pricing front, prices are still holding at historically high levels for yet another week, while given the trends noted in terms of earnings and the ample buying appetite still seen in the market, we expect this trend to hold and even witness further price hikes during the summer months ahead. On the tanker side, overall activity has held at impressively high levels these past few weeks and has covered most size segments of the sector.

Buying interest is still holding firm with a fair amount of enbloc deals emerging this week. With freight rates having made a fair bit of gains over the past months and many expecting a further improvement to be noted down the line, it seems as though this recent trend in the secondhand market still has ample momentum”.

Banchero Costa added that “in the dry market, Couple of Panamax Bulkers reported sold last week. Palais 75,000 dwt Blt 2014 Rongsheng reported sold to Chinese Buyers at $22 mln, Vessel is BWTS fitted. Rosco Olive 75,000 dwt Blt 2010 Sasebo reported sold to European Buyers at $25 mln. Carras controlled Aquadiva 182,060 dwt Blt 2010 Odense reported sold at $32.6 mln. A KS purchased the Ultramax Belpareil 64,000 dwt Blt 2015 Nantong for $29.9 mln. Vessel reported sold to a local KS where sellers will participate in the equity. Handy Great Intelligence 38,797 dwt Blt 2017 Huangpu reported sold to undisclosed Buyers at $21.5 mln basis BB back to sellers at $5,300/d till Dec 2022”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software