Sudden spurt of Russian crude flows to India calls for better price discovery

When a trade flow change comes unforeseen, price transparency becomes the need of the hour for market participants eying a piece of that trade.

The Russian invasion of Ukraine in 2022 resulted in significant upheaval for global crude oil markets – both for prices as well as for trade flows.

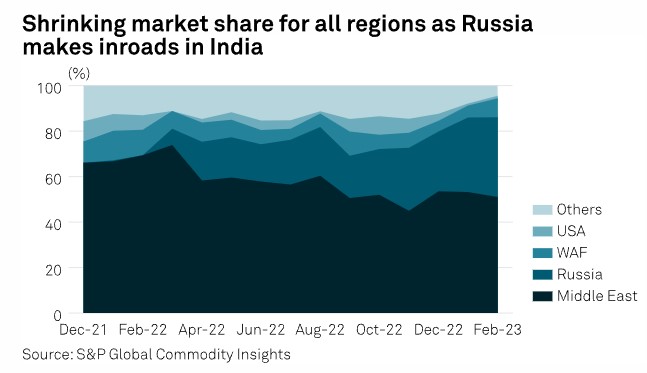

One of the most talked about phenomena for oil markets in the last one year has been the realignment of Indian crude oil flows, with an ever-increasing flow of Russian cargoes into the South Asian country.

Russian crude flows to India

Indian refiners have not been traditional consumers of Russian crude owing to the geographical distance and logistical inefficiencies from smaller vessels. The world’s third-largest consumer of oil, which was heavily dependent on Middle East, West African and US crude oil imports, found a cheap crude oil source in Russian barrels as European countries started shrugging them away post-Russian invasion.

The European price cap, which took effect in December 2022, has not helped Russian crude flows to Europe. But more of it continues to flow into India and China on a massive “shadow fleet” of tankers believed to have been built up ahead of the price cap implementation.

Trend is here to stay

The Urals crude oil grade was historically supplied into Europe using a massive network of trans-continental pipeline networks and through ports in the Baltic as well as Black Sea. Owing to its geographic proximity, most of the Russian barrels used to find home in European refiners. Therefore, the price of the grade was assessed at Rotterdam, and represented the value that mainly European refiners saw in the grade.

Since that trade has been replaced by a novel flow to India, there have been wide market speculations on the level of prices Indian refiners have been paying for the distressed grade shipment in small-sized Aframax vessels.

In addition, difficulties in securing insurance, hurdles in securing ships and financing, as well as payment-related issues meant that the landed price of these barrels to Indian refiners are looking quite different as compared to the CIF Rotterdam price for Urals crude.

Among the keen watchers of this market include various regulators, government and non-government entities around the world trying to find the value of Russian crude oil to determine how the efforts to curtail oil revenues has been working.

The crude oil trading community have been watching this flow keenly as well, since invariably the deeper discounted barrels from Russia has been giving tough competition to spot barrels from the Middle East, West Africa as well as the Atlantic basin.

For instance, the price of some key Nigerian grades preferred by Indian refiners saw some downward pressure in 2022 as the refiners were looking towards Urals crude to fill the spot volumes instead.

Russian oil flows to India have been barely a year old, but at around 1.5 million b/d it already makes up more than 30% of Indian crude oil imports. The massive inflows seem unlikely to dissipate anytime soon owing to the geopolitical situation in Europe, where the negative sentiment towards consuming Russian energy is expected to remain for now.

The flow of Russian oil into India has mostly remained on Delivered at Port (DAP) terms, as the unconventional logistics of Urals into India looks difficult for domestic refineries to handle, while economic incentives of discounts are large enough to keep the interest alive for those cargoes in the foreseeable future.

Finding the right value

Platts, part of S&P Global Commodity Insights, launched an assessment of Russian Urals crude on a West Coast India DAP basis effective Jan. 18.

The assessment is published as both an outright price, and as a differential to M1 forward Dated Brent. It reflects an Aframax cargo size, typically 80,000-100,000 mt, and is assessed for an M+1 delivery period into West Coast India.

The independently assessed value of Urals crude in India provides much-needed transparency on the value of Russian crude oil being delivered into the South Asian country. Since the launch, there has been significant interest in the assessment as analysts, governments, refiners, traders, sellers and buyers have started to get a fair understanding of the price for one of the most talked about oil flows in the world.

The price has been keenly watched by various market participants and used as an important point of reference when trading Russian crude oil volumes, especially when the same is being traded through non-traditional supply sources.

The flow of this oil and its economics will continue to remain a key theme in the Indian refining space that continues to grow in size, making India an important source of global oil demand growth.

“India’s refining runs are expected to grow from 5.25 million b/d to 5.9 million b/d by 2025 as fuel demand continues to grow at 4.50 %,” Sumit Ritolia, refinery analyst from S&P Global, said.

Price assessments not only bring some clarity in the opaque post-invasion world of Russian oil flows, but also signals an important reference point for the wider market, which directly or indirectly is impacted by this trade flow realignment.

Source: Platts

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software