Tanker Scrapping Underwhelming So Far in 2021

Buyer interest has hampered the scrapping of older tonnage so far this year, despite all other factors being supportive of more demolition sales. In its latest weekly report, shipbroker Gibson said that “despite almost every driver being supportive, scrapping activity has continued to underperform during 2021. Gibson remains convinced that a key driver behind this is the presence of buyers willing to pay a premium price for vintage tonnage to operate in sanctioned trades. Focusing on the large tanker fleet, a significant proportion of older units sold in the past year have become involved in illicit activity. For now, the presence of these ‘dark ships’ is contributing to prolonged weakness in the freight markets, but could their time soon be up, and will they be forced to scrap in the not-too-distant future?”

Buyer interest has hampered the scrapping of older tonnage so far this year, despite all other factors being supportive of more demolition sales. In its latest weekly report, shipbroker Gibson said that “despite almost every driver being supportive, scrapping activity has continued to underperform during 2021. Gibson remains convinced that a key driver behind this is the presence of buyers willing to pay a premium price for vintage tonnage to operate in sanctioned trades. Focusing on the large tanker fleet, a significant proportion of older units sold in the past year have become involved in illicit activity. For now, the presence of these ‘dark ships’ is contributing to prolonged weakness in the freight markets, but could their time soon be up, and will they be forced to scrap in the not-too-distant future?”

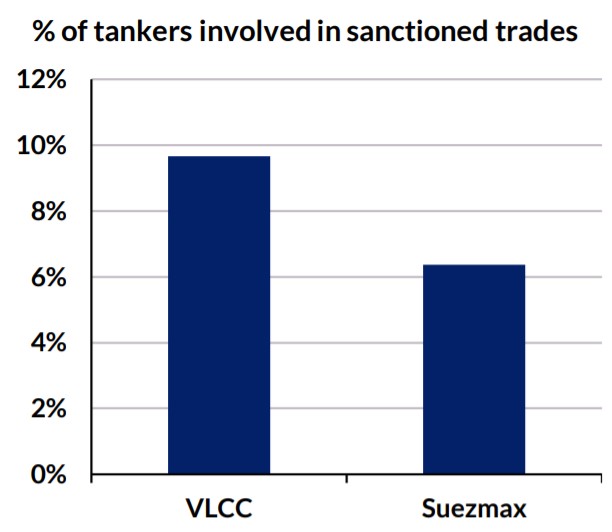

According to Gibson “perhaps one of the most important factors driving demand for older tonnage is US sanctions. Embargoes against Iran and Venezuela have forced buyers and sellers of sanctioned crude to find owners willing to risk the wrath of the US government. These owners are usually small, previously unknown single ship owning entities and often the vessels are likely to have been sold several times through multiple entities before ending up with the final owner, evading even the most stringent know your client (KYC) procedures. Gibson now tracks vessels which it suspects, but cannot always prove, are involved in Iranian or Venezuelan trade. At present we suspect up to 10% and 6% of the VLCC and Suezmax fleets respectively are involved in such activity. The actual number is likely to be higher with some vessels recently sold yet to sail from the delivery location, whilst other vessels are yet to perform illicit activity, but look likely to do so (and will be counted when they do)”.

Source: Gibson Shipbrokers

The shipbroker added that “earlier in the year we heard unsubstantiated reports of an ageing VLCC being offered $100,000/day for a 6- monthtime charter for Venezuelantrade – more than 5 times the prevailing market rate for regular trade at the time. Such a deal would generate $18.25 million in revenue, allowing the owner to recoup approximately 75% of the value of the ship (less operating costs), and still have the residual value of the vessel, making a significant profit by selling the vessel for scrap, or performing another similar charter”.

“But whilst suchprofits can be earned by these vessels in the short term, their future is in doubt. The biggest short-term risk comes from the talks taking place between the US and Iran, which could see sanctions relief. If a sanctions deal is agreed, then vessels involved in Iranian shipments will see their freight rates drop to ‘market’ levels, and in many cases will be untradable due to their commercial history and vetting concerns, ultimately leaving few other options but to scrap, or try to find employment out of Venezuela. However, whilstthe timeline looks longer, Venezuela might also achieve sanctions relief, even if it is more limited. Although the Biden administration appears less willing to engage with Venezuela, Maduro has recently taken small steps to ease tensions, and pressure in Washington is growing to allow crude for diesel/gasoline swaps on humanitarian grounds”, Gibson said.

“Further, demand in these illicit trades is finite, and eventually the market will become saturated. In addition, rising scrap prices have put scrap prices above 20-year-old second hand values, making it increasingly attractive to sell into the demolition market. Additionally, with China introducing a tax on bitumen mix imports from June 12th, the incentive to import sanctioned crudes described as bitumen mix may soon be eroded. In summary, sales into these illicit trades are expected to slow down, whilst any sanctions relief will erode the premium rates paid for such activity. However, the fact that such a large portion of the crude tanker fleet is now effectively untradeable bodes well for the future. These vessels are unlikely to ever return to compete in the regular market, and when production rises and if sanctions are removed, the international fleet will be the main beneficiary”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software