UK aims to shape global fintech regulation as it bridges EU divorce – experts

The U.K.’s fintech bridges initiative, a series of bilateral agreements with five APAC countries designed to help young companies enter new markets, could strengthen the country’s hand in shaping global fintech regulation after the Brexit transition period ends, according to industry observers.

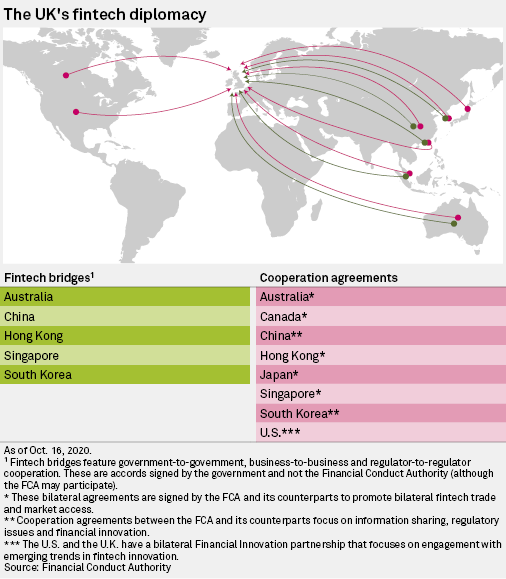

Britain currently has fintech bridges with Hong Kong, Singapore, China, South Korea and Australia, in addition to various fintech co-operation agreements with the U.S., Canada, China, Hong Kong, Japan and South Korea. The bridges involve co-operation between regulators, government and businesses on both sides of the bridge.

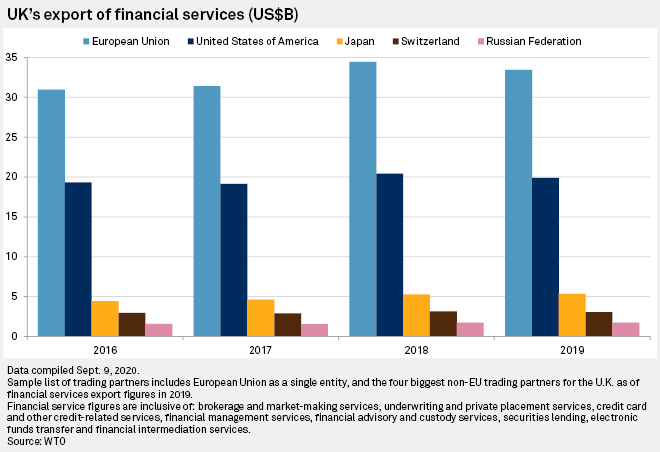

The U.K. left the EU earlier in 2020 and the transition period ends on Dec. 31. The vast majority of the U.K.’s financial services exports go to Europe, totaling $33.46 billion in 2019, according to the World Trade Organization. But with the possibility of a no-deal Brexit threatening to close doors on the continent at the end of the year, many U.K. fintechs are considering growth opportunities further afield.

Soft power

William Samengo-Turner, partner at law firm Allen & Overy, said fintech bridges give the U.K. an opportunity to influence international regulatory norms.

The U.K. Financial Conduct Authority has “comparatively deep” experience in regulating fintech, and regulators in other countries often approach them for advice when it comes to designing their policies, he said. The FCA Sandbox for example, set up in 2016 as an environment for early-stage fintechs to test new products, is a model that has been copied by several countries around the world, he said. Participants in the sandbox to date include Open Banking specialist Bud, which now counts large banks such as Goldman Sachs Group Inc. and Banco de Sabadell SA among its clients, and identity verification startup Onfido Ltd., which provides digital know-your-customer services for fintechs including Monzo Bank Ltd. and Revolut Ltd.

“[Fintech bridges] are, by their nature, designed to foster collaboration and deeper ties between regulators at either end of the relevant bridge and, used skillfully, it is easy to see the potential for the U.K. to develop significant soft power in this area,” he said in an email.

If fintech regulation in countries on the other end of bridges looks like that in the U.K., then it would be “enormously beneficial” for British fintechs looking to set up shop in new markets in the long run, he said.

Russ Shaw, founder, Tech London Advocates & Global Tech Advocates, both U.K.-based trade associations, also believes that fintech bridges could be a way for the U.K. to shape global regulatory norms.

“As well as nurturing global collaboration, contributing to setting these standards could help solidify the U.K.’s position as a true fintech leader,” he said in an email.

But there are some areas where this could hit a snag, Samengo-Turner warned.

“The potential here has, however, to be balanced by the pressures of local politics and customs; an increasingly fractious geopolitical situation; and local regulators simply developing opposing views,” he said, citing China’s approach to cryptocurrencies as an example.

Regulators in China do not consider private-sector cryptocurrencies as legal tender, in contrast to the FCA, which does.

The Brexit effect

Volumes of financial services exports from the U.K. to countries covered by fintech bridges are still small when compared with those to the EU — exports to Australia, for example, stood at just over $1 billion in 2019, while exports to Singapore stood at $848 million.

For Tony Craddock, director general of the Emerging Payments Association, a trade body, it makes sense for British fintechs to look East. Fintechs in expansion mode are taking “a mighty risk” if they rely too heavily on business opportunities in the EU, and those that want to grow in a post-Brexit world need to be thinking about APAC, he said.

“When a country decides to leave its largest trading partner, for whatever democratic reason, it is turning off the tap to commercial opportunities. Significantly. We are currently in the final phase of negotiating the details of our trade agreement with the EU, but it is our expectation that it will not allow passporting [of financial services between the U.K. and EU], and that there will be both overt and covert obstacles preventing U.K. companies doing business inside the EU in future,” he said in an email.

In this situation, fintech bridges can offer companies access to information and to key figures in business and government that would otherwise have been hard to come by, Craddock said.

However, they will never been able to entirely remove the risks or complexities of entering new or unfamiliar markets, he cautioned.

New relationships

Sunil Chandra, platform CEO of OakNorth, has first-hand experience of the fintech bridge scheme, and said that it has made life easier for the company as it seeks to expand its software-as-a-service business — as distinct from the lending business, OakNorth Bank plc in Australia.

“As part of the bridge, we’ve joined past fintech trade missions which have given us the opportunity to meet a number of institutions who we’re now in active conversations with, and we’ve had introductions to regulators and policy makers which has helped us explain our approach as well as gain a better understanding of the priorities for the regulatory environment,” Chanda said in an email.

So far, 20 fintech companies, of which OakNorth is one, have set up in Australia as the result of the fintech bridge, Jennifer Mackinlay, Australia’s senior trade and investment commissioner for the for the U.K., Ireland and the Nordics said during an Oct. 7 webinar.

One of these is London-based Crowd2Fund Ltd. It struck up a relationship with local fintech InDebted Pty Ltd, which is backed by major Australian bank Westpac Banking Corp. Open Banking business platform Trade Ledger Limited has set up shop in both Australia and Hong Kong through the fintech bridges.

Source: Platts

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software