An uneven revival in newbuilding orders

Investors have ordered a larger tonnage of new vessels at shipbuilding yards this year. But the newbuilding revival has not been evenly spread among ship types. Amid the imponderables of regulation and technology, what is shaping the trends and outlook?

Investors have ordered a larger tonnage of new vessels at shipbuilding yards this year. But the newbuilding revival has not been evenly spread among ship types. Amid the imponderables of regulation and technology, what is shaping the trends and outlook?

Global orders for newbuildings have rebounded during 2021, reflecting improved freight markets and earnings coupled with renewed optimism about prospects in the years ahead. The main world merchant ship fleet categories have not participated equally in the ordering upturn, however, which has featured the container ship segment. Looking at the broad trend, there are clear signs of restraining influences and these may persist.

Compared with some previous phases of increased vessel ordering, when substantial freight market improvements and greater confidence about the future unfolded, the 2021 recovery is mostly more cautious. The principal difference is the now prevailing uncertainty about what fuels and technology to adopt, to ensure compliance with tightening regulations and mounting stakeholder pressures for decarbonising shipping activities.

Another visible restraint is uncertainty about the outlook for the growth of world seaborne trade in the longer term. Several large volume components – especially oil and coal – employing a major part of the world merchant ship fleet seem set to experience sustained downwards pressures eventually, because of the global shift to cleaner energy sources. This limitation could result in slower overall trade expansion, or perhaps even contractions in trade.

Ordering trends in past years

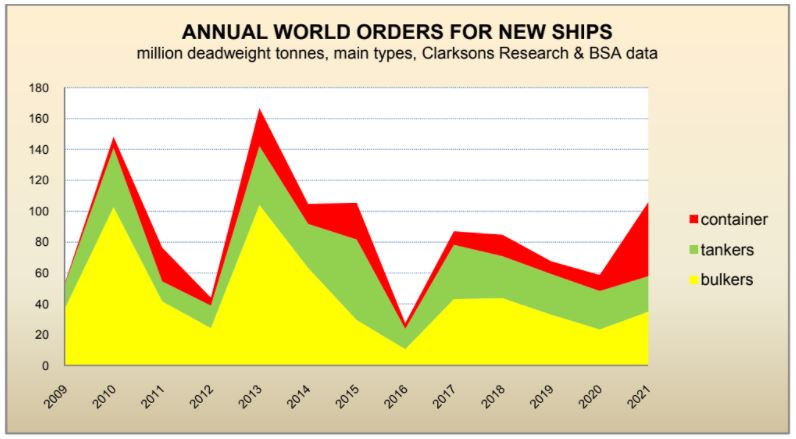

After a collapse five years ago and the revival which followed, a declining orders trend was seen in the past two years, as shown by the graph. Merchant ship newbuilding orders at the end of 2020 – bulk carriers, tankers, container ships, gas carriers and other types – comprised a low 7.5% of the world fleet, based on Clarksons Research data. Since then a rise to 9.3% of the existing fleet at end-October 2021 has ensued as orders picked up.

Disciplined ordering in recent years was mainly influenced by lengthy periods of subdued freight rates, and the necessity of reducing the imbalances between vessel demand and supply trends which was the underlying cause. Lowering new capacity entering the market was seen as a major contributor to achieving a tighter balance enabling improved vessel earnings.

Disciplined ordering in recent years was mainly influenced by lengthy periods of subdued freight rates, and the necessity of reducing the imbalances between vessel demand and supply trends which was the underlying cause. Lowering new capacity entering the market was seen as a major contributor to achieving a tighter balance enabling improved vessel earnings.

An additional influence on the fleet’s evolution has come to the forefront over the past several years. A focus on decarbonising the world merchant ship fleet, and what changes in fuels and technology will be required to achieve this objective, has intensified. Some shipowners have made definite decisions to use specific alternative fuel in new ships, or at least to include the option of using these in the future. Many other owners apparently have been deterred from or at least have hesitated in placing orders, because of extreme uncertainty about the fuels which will be acceptable over a typical vessel lifetime of up to twenty five years.

In the past decade or more up to 2020, extended periods of subdued or depressed freight markets were heavily influenced by excessive fleet growth. Excess capacity largely reflected over-ordering of new ships amid what proved to be undue optimism about future freight rate trends. Although this description is a broad generalisation, with patterns varying among the sectors, surplus capacity was a prominent feature which still prevails in some parts of the wider market, the tanker segment in particular.

Preceding this period an exceptionally high peak in annual newbuilding orders placed was seen in 2007 towards the end of a long freight market boom. In that year 264 million deadweight tonnes of merchant ships were ordered. Coupled with high totals in both the previous and following years, the 3-year 2006-2008 order total was 659m dwt, equivalent to almost three-fifths of average existing fleet capacity during those years. At the end of 2008 the newbuilding orderbook was equivalent to 52% of the world fleet, a peak proportion.

Since then a downwards trend in the orderbook as a percentage of the existing fleet has evolved. Within this trend the annual newbuilding orders volume placed varied, as shown in the next graph for the period 2009 to 2020. Totals are shown for ships in the three largest categories – bulk carriers, tankers and container ships – using data compiled by Clarksons Research, accompanied by Bulk Shipping Analysis estimates for 2021 incorporating ten months provisional data combined with guesses for ordering in the remaining two months.

Recent ordering patterns

The 2020 total for new merchant ship orders placed worldwide was 67m dwt, continuing a decline over the past three years from 95m dwt in 2018 and 78m dwt in 2019. Last year’s ordering activity was affected by the onset of the coronavirus pandemic, and its effects on freight and shipbuilding markets and market sentiment, but the precise impact is difficult to evaluate.

Reductions in the total last year and in the previous year were mainly caused by declining bulk carrier orders, reflecting subdued freight rates and shipowners’ limited confidence in a sustainable market improvement. Other influences, including the uncertainty about alternative fuels and propulsion technology were also evident. Bulk carrier orders shrank from almost 44m dwt in 2018 to 33m dwt in 2019 and 23m dwt in 2020. There was an especially large reduction in the capesize group, comprising ships of 100,000 dwt and over, which includes larger newcastlemax vessels and very large ore carriers. Annual orders in this category declined from 21m dwt in 2018, to under 16m dwt in 2019 and 7m dwt in 2020.

Elsewhere, changes in newbuilding order volumes during 2020 were relatively small. Tankers were down by one million deadweight tonnes to 25m dwt, and LNG carriers were almost unchanged at about 5m dwt. By contrast container ship orders increased, by more than 2m dwt to exceed 10m dwt, mainly due to additional contracts for larger ships in the 8,000 twenty-foot equivalent unit and over size category.

During the first ten months of 2021 orders placed in several vessel categories have already exceeded annual totals seen last year. Container ship contracting activity is experiencing a spectacular expansion, while bulk carrier orders have increased, but restrained tanker ordering is evident. Among other ship types (not shown individually in the graph) orders for liquefied natural gas carriers have risen, and liquefied petroleum gas carriers orders are much stronger.

By far the most pronounced change among vessel types this year is the surge in container ship orders, provisionally totalling 43m dwt in the January-October period. Deadweight figures are used in these order statistics, although container ship capacity is usually measured using the standard teu box measurement. Amid rapid recoveries in the container freight box and container ship charter markets, newbuilding container ship orders have exceeded the 41m dwt total seen in the past four years, 2017 to 2020, together.

At end-October 2021 the world merchant ship orderbook was equivalent to 9.3% of existing tonnage, reaching 204m dwt, about a sixth above the end-2020 total of 175m dwt. Within the end-October volume bulk carriers, container ships and tankers totalled 64m, 60m and 51m dwt respectively, together comprising 86% of the orderbook. As a percentage of the existing fleet in each category, bulk carriers and tankers were low at 7-8%, while container ships were high at 21%. Calculations for LNG carriers show an even higher 26% proportion.

Ships incorporating ‘green’ technology to reduce or eliminate carbon emissions now comprise a large part of the overall merchant vessel orderbook. Just over a third of all orders measured by tonnage will be able to use alternative fuels or propulsion. The majority is designed for LNG fuel use, accompanied by some using LPG. Limited numbers will use methanol, ethane, biofuels, hydrogen, or battery/hybrid propulsion.

Another aspect relevant to new vessel contracting activity is the prices agreed with shipbuilders. The broad trend of newbuilding prices has been strongly upwards this year, influenced by rising steel costs and by tightening shipyard berth availability, amid increased ordering especially for specific ship types. As examples of price escalation, 30-45% rises for large container ships, and 25-35% for large bulk carriers and tankers reportedly have evolved over the past twelve months.

Impact on the future fleet

How will recent ordering patterns, augmenting previous orders placed, affect deliveries of newbuilding vessels (completed volumes) in the period ahead? During the remainder of 2021 and into 2022 newbuildings delivered to owners and becoming operational will be the result of contracts placed earlier in 2020 and in the previous year.

The duration of the interval between ordering and delivery usually reflects shipbuilders’ order ‘backlogs’ or the length of their orderbooks. This interval varies with market circumstances, and may be as long as three or exceptionally even four years. Occasionally the interval is described inaccurately as the construction period. Generally ships are constructed in a shorter period (except for more sophisticated or technically complex types) and construction work begins much nearer the delivery date.

Orders placed later in 2020 and through 2021 probably will be mostly delivered during 2022 and 2023, followed by some in subsequent years. According to Clarksons Research calculations, as at end-October 2021, about 13m dwt of the current 204m dwt world orderbook for merchant ships is scheduled for delivery by the end of this year. In 2022 a 78m dwt scheduled total is estimated, although that figure may be revised upwards. Current orders suggest a further 70m dwt scheduled deliveries in 2023 but this total also is likely to rise as more orders are added.

Newbuilding deliveries scheduled for 2022 suggest that the annual total will be below the current year’s volume. This outcome could assist in moderating fleet expansion. However the 2022 figure may be revised upwards when, as often happens, late or postponed deliveries from the preceding period are added. Fleet growth also reflects scrapping activity, prospects for which are typically hard to predict accurately.

Persisting restraints

A continued generally restrained approach to newbuilding orders could contribute to preserving firmer freight markets into 2022 and potentially beyond. Shipowners’ collective self-discipline in augmenting fleet capacity with new vessels has been most noticeable recently within the bulk carrier segment, comprising well over two-fifths of the world merchant ship fleet. Such a trend may promote a tighter balance between vessel supply and demand than has been seen in many preceding years.

When newbuilding orders were restrained in earlier periods a prominent influence typically was an unfavourable freight market demand/supply balance. Usually also an absence of confidence in prospects for a sustained market improvement was apparent. Ideas emphasising uncertainty about the market outlook were conspicuous. Such uncertainty in varying degrees always affects asset decisions, with a particularly large influence when heavy capital investment is involved.

During the past few years doubts about how the future shipping industry will evolve have become amplified. Currently this uncertainty is still at an exceptionally elevated level, and signs point to it remaining magnified over a prolonged period ahead. Given the restricted visibility about future ship employment economics and operations over the typical lifespan – in the twenty to twenty five years range – of a newbuilding vessel, evidently many owners are reluctant to commission new tonnage until some of the obscurity recedes.

Prevailing perplexities

The conundrum of how the global shipping industry’s commitment to greatly reducing greenhouse gas emissions will be fulfilled, over the period up to 2050, largely explains elevated uncertainty. Substituting fossil fuels, and modifying ship technology for alternative fuels such as ammonia and methanol or many others being considered, is needed. To assist this process, numerous theoretical perceptions of how decarbonisation can be achieved, and various pathways to reach the objective have been suggested and modelled.

But the practical aspect of which alternative fuel and what technology to adopt in any new individual ship ordered is usually not yet obvious. Consequently decisions about how to respond to the energy transition, except in limited parts of the world fleet, are still elusive. A further complication is ensuring that the most competitive fuel type in a ship’s early life remains so throughout its existence. The probable future tightening of international regulations on emissions, with implications for fuels, is not easy to predict either in extent or timing or both.

Another pervasive uncertainty arises from the global energy transition. The impact on seaborne trade volumes – which seems clear in direction, but the pace of change is not distinct – affects shipping market sentiment and decisions on fleet capacity and newbuilding requirements. Pressure and policies to drastically reduce global greenhouse gas emissions have already adversely affected world seaborne trade. Even greater negative effects on bulk trade volumes over the years ahead are widely expected.

Amid the switch to cleaner energy sources, fossil fuel consumption is set to decline. Cargoes of fossil fuels – especially coal and crude oil – on long haul routes, comprising a large proportion of employment for bulk carriers and tankers, seem almost certain to diminish although the amount and rate of decline during the next ten or twenty years is hard to forecast reliably. Indications suggest that it may prove difficult for increases in other cargo volumes to offset this weakening portion, implying slower overall sea trade growth than seen in recent years. Such perceptions have implications for the new capacity required to contribute to fleet expansion.

These are profoundly puzzling aspects of the longer term outlook for shipping markets. Such perplexity apparently explains much of the slower growth in newbuilding orders, in some parts of the industry, than previous market upturns prompted. Exceptional ongoing uncertainty about future influences points to this relatively restrained ordering activity persisting.

Source: Article for Hellenic Shipping News Worldwide (www.hellenicshippingnews.com), by Richard Scott, managing director, Bulk Shipping Analysis and visiting lecturer, London universities

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software