Commodity Tracker: 5 charts to watch this week

S&P Global Commodity Insights editors forecast coastal West Africa as the emerging new oil region, but experts warn that instability and extremism could affect the investments. The editors are also focusing on dry bulk freight rates due to increased demand. Meanwhile, soybean meal production in China is estimated to increase in 2024.

1. Instability, poor governance threaten coastal West African oil belts

What’s happening? The West African coastal states are emerging as a new oil and refined product belt following discoveries off Ghana and Cote d’Ivoire, the new Niger-Benin export pipeline and Togo’s emergence as a product import hub. Ghana is producing 130,000 b/d of crude and plans to pump more, while Cote d’Ivoire production is set to rise from the current 50,000 b/d to 225,000 b/d by 2036, according to S&P Global Commodity Insights forecast, driven by Eni’s Baleine project. However, African and Western officials are sounding the alarm about the spill-over of extremism and instability from the coup-plagued Sahel region, where terror groups have taken hold.

What next? Benin will start exporting 90,000 b/d of Nigerien crude from April. Togo will continue to export refined products around the region, thanks to its sophisticated Lome port. With the region growing in importance as an oil and products hub, the US and EU have pledged tens of millions of dollars in security assistance, following coups in neighboring Niger, Burkina Faso and Mali. While the coastal states remain relatively peaceful and prosperous, analysts say instability and extremism could threaten vital investment.

2. Dry bulk shipping markets experience stable start

What’s happening? The Platts Dry Index averaged in Q1 at $23,621/day (basis scrubber fitted ships) and $19,349/day (basis ships burning 0.5% bunker fuel), exhibiting a steady start to the year for the dry bulk shipping markets and defying the historical trend of seasonally poorer rates in Q1. This phenomenon is attributed to a variety of factors, including firm Chinese iron ore and coal demand to replenish stocks prior to the Lunar New Year in February 2024, as well as increased export volumes of east coast South America soybean cargoes amid an earlier harvest.

What’s next? Sources pointed out that tonnage demand for moving West Africa bauxite were easing, adding that a decline in iron ore prices might stifle trades. This could result in lower demand for moving seaborne iron ore and bauxite cargoes. Furthermore, market participants also indicated an expected decline in soybean and grain export volumes from east coast South America around April, potentially exerting downward pressure on the dry bulk freight and Platts Dry Index in the near term.

3. Permian natural gas production close to record highs, testing pipeline capacity

What’s happening? Natural gas production in the Permian Basin has been rising almost as quick as midstream companies can build pipeline takeaway capacity. It has remained strong into the shoulder season, averaging 18.3 Bcf/d April 1-8, only slightly lower than the record of 18.7 Bcf/d in December 2023. The robust production has combined with falling demand and maintenance at pipelines to send cash prices at Waha in West Texas regularly below zero since mid-March. Platts assessed Waha at minus $1.83/MMBtu for April 9 flows.

What’s next? The 2.5 Bcf/d Matterhorn Express Pipeline will give space for incremental production when it begins service in Q3. Midstream companies expect another greenfield pipeline out of the Permian will be needed by the end of 2026.

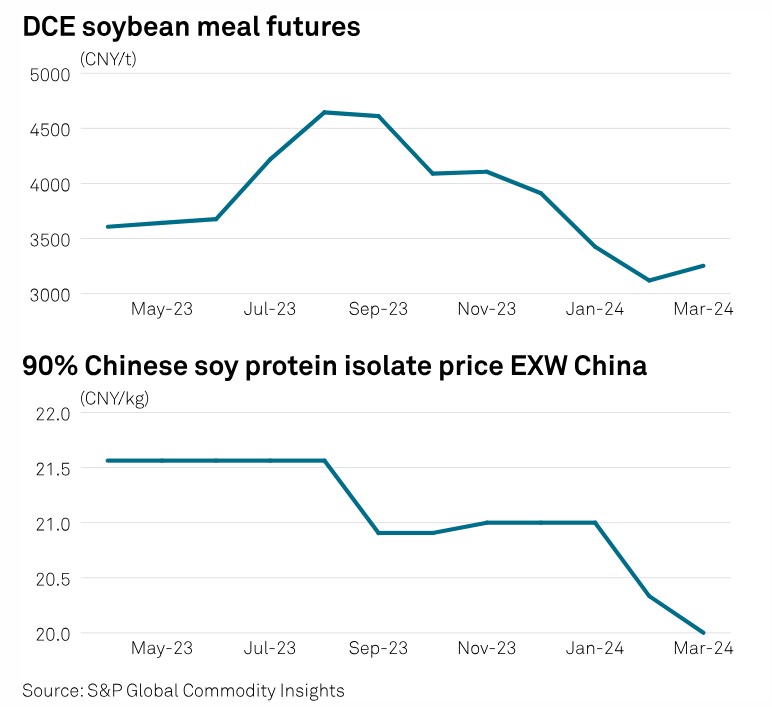

4. Increased soybean meal production drives down Chinese soy protein prices: USDA

What’s happening? The United States Department of Agriculture’s Beijing post recently estimated China’s 2023 and 2024 soybean meal production to increase 1% year on year to 76.82 million mt, compared to the 2% year on year increase to 77.62 million mt estimated in the March World Agricultural Supply and Demand Estimates report. The anticipated increase in soybean meal production is driven by competitive pricing for feed and overall strong demand from the feed sector. As a result, Dalian Commodity Exchange’s soybean meal futures and 90% Chinese soy protein isolate price EXW China have both fallen steadily since August 2023.

What’s next? While increased production of soybean meal could drive down soy protein prices in the short term, it also signifies increased production of animal products. Consumer preferences between animal and plant-based proteins remain key in determining the future of plant-based proteins in the country.

5. Utilities face challenges due to AI-centered capital spending

What’s happening? Power demand from operational and currently planned data centers in US power markets is expected to total about 30,694 MW once all the planned data centers are operational, according to analysis of data from 451 Research, which is part of S&P Global Market Intelligence. Growing power demand will “stress utility company balance sheets as capital spending escalates to upgrade the infrastructure and integrate renewable energy resources,” Morningstar analysts said in the commentary titled “Watts Up With AI: Strategies for Utilities in an Era of Surging Demand.”

What’s next? Investor-owned utilities are set to supply 20,619 MW of the planned capacity. For utilities with data centers in their service territories, proactively investing in renewable energy power developments and grid modernization could provide “operational or financial improvements,” driven by increased efficiency and grid stability along with higher revenue from greater power demand.

Source: Platts

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software