More Newbuildings and Second Hand Tonnage Traded this Past Week

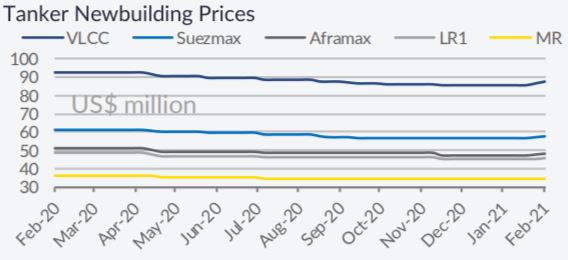

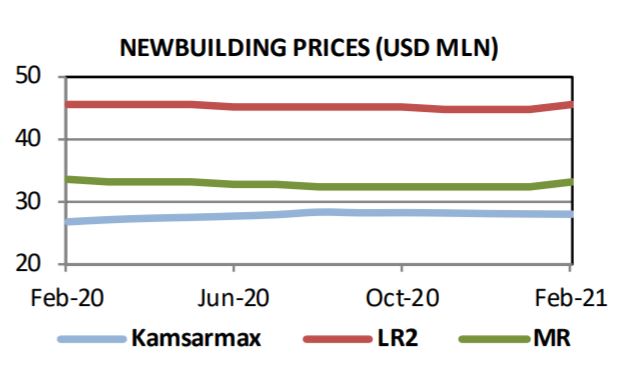

Newbuilding orders picked up over the past week, while many ship owners also opted for more secondhand tonnage. In its latest weekly report, shipbroker Allied Shipbroking said that “a moderate rise in activity was seen this past week, without any impressive figures though being noted. In the dry bulk sector, we witnessed the return of many buyers in the newbuilding market, with the positive momentum now resumed in the segment, despite some losses noted this past week in the freight market. Prospects remain robust for the time-being and thus more and more buyers are seeking for offers from shipbuilders everyday, during a period were newbuilding prices are still below their 5-year average figures. This past week, we noticed an impressive order for 2+2 Capesizes from Taiwanese interest and two orders to Chinese shipbuilders for 3+1 Ultramaxes in total. On the tankers side it was also an improved week in terms of the volume of transactions noted, but again with just modest numbers. The devastating conditions in the current freight market and the hurt sentiment has diminished appetite in the segment. However, this past week we saw a fresh order for 1+1 Aframaxes being placed by Greek interests, as well as three orders for 6+1 MRs in total. We do not expect activity to further ramp up anytime soon though, as fundamentals are still looking overall pesssimistic”, the shipbroker said.

Newbuilding orders picked up over the past week, while many ship owners also opted for more secondhand tonnage. In its latest weekly report, shipbroker Allied Shipbroking said that “a moderate rise in activity was seen this past week, without any impressive figures though being noted. In the dry bulk sector, we witnessed the return of many buyers in the newbuilding market, with the positive momentum now resumed in the segment, despite some losses noted this past week in the freight market. Prospects remain robust for the time-being and thus more and more buyers are seeking for offers from shipbuilders everyday, during a period were newbuilding prices are still below their 5-year average figures. This past week, we noticed an impressive order for 2+2 Capesizes from Taiwanese interest and two orders to Chinese shipbuilders for 3+1 Ultramaxes in total. On the tankers side it was also an improved week in terms of the volume of transactions noted, but again with just modest numbers. The devastating conditions in the current freight market and the hurt sentiment has diminished appetite in the segment. However, this past week we saw a fresh order for 1+1 Aframaxes being placed by Greek interests, as well as three orders for 6+1 MRs in total. We do not expect activity to further ramp up anytime soon though, as fundamentals are still looking overall pesssimistic”, the shipbroker said.

In a separate report this week, shipbroker Banchero Costa added that “U-Ming of Taiwan has placed a 2+2 order at Qingdao Beihai for Newcastlemax bulkers abt 210,000 dwt for delivery December 2022 and June 2023. Price is USD 67 million apiece. Atlas Maritime have placed a single order (plus one option) for an Aframax tanker abt 115,000 dwt at Daehan, South Korea at a price of rgn USD 46 mln for delivery March 2022. Same also by their compatriots Chandris, at similar price, but delivery September 2022.

ICDAS of Turkey will build for their domestic client two chemical/ product tankers of about 4,500 dwt”.

Meanwhile, in the S&P market this week, shipbroker Allied Shipbroking added that “on the dry bulk side, an impressive number of transactions emerged across the whole sector once again. Despite a correction noted in freight earnings for some size classes this past week, sentiment remains bullish amongst buyers. This past week, we saw deals taking place across different size sectors, but focus was mainly given once again to smaller size units. However, the rising trend in second-hand prices is expected to trim some buying interest, as we are now reaching or even surpassing their 5-year average figures.

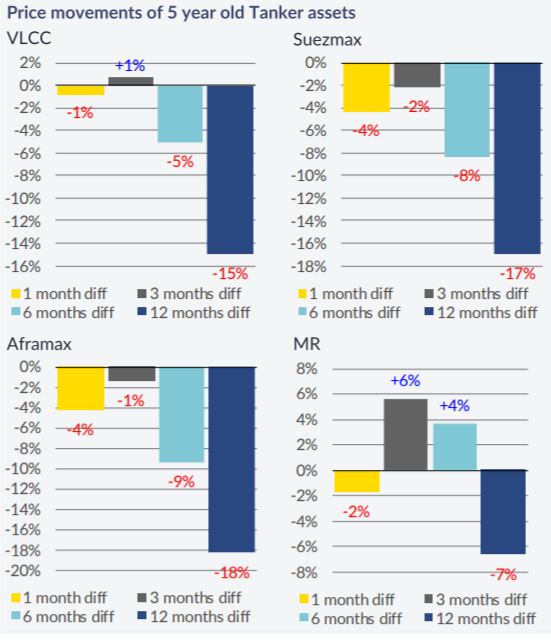

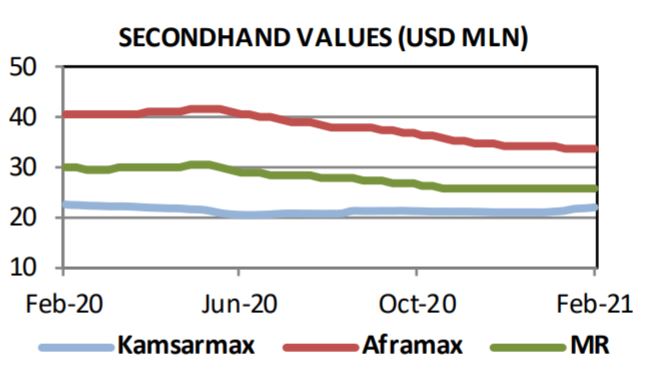

On the tankers side, the subdued activity resumed with little surprise though given the uninspiring picture portrayed in the freight earnings during the last few months. However, it is worth mentioning that there was an increased number of deals this past week, in an attempt by buyers to take advantage of the falling prices. The modest transaction figures are expected to continue, as long as sentiment remains weak on the back of poor fundamentals in the sector”, the shipbroker concluded.

Similarly, Banchero Costa added that “In the dry bulk sector, a strong appetite was recorded during the week for Panamax/Kamsarmax. A Japanese controlled post-Panamax, Kind Salute abt 95k blt 2011 Imabari, has been sold at USD 16.5 mln. End of last year sister vessel Maritime Century abt 95k blt 2010 Imabari was done at USD 14.5 mln. Furthermore, two resale Tsuneishi Zhoushan Ursula Manx and Unax Manx abt 82k blt 2021 were bought by clients of Shandong Shipping Corp. at USD 29.5 mln each. Chinese buyers were behind the purchase of Vassos abt 76k blt 2004 Tsuneishi (BWTS fitted) at USD 8.6 mln, last week Ajax abt 76k blt 2006 Oshima at USD 10.2 mln. Two Tier II Supramaxes Nordic Tianjin and Nordic Harbin abt 57k blt 2012 Yangzhou Guoyu have been sold at USD 18.55 mln en bloc basis.

Three weeks ago Glovis Madonna abt 57k blt 2013 Tianjin Xingang was reported at USD 9.7 mln. An open hatch boxed Supramax Red Jacket abt 52k blt 2008 Oshima has been reported at USD 8.8 mln to Chinese buyers. In the handy segment two Japanese controlled Handysize were reported sold to Greek Buyers, Sapphire Island abt 33k blt 2012 Shin Kurushima, Basic Ocean abt 33k blt 2012 Shin Kurushima at USD 10.6 mlneach. Two weeks ago Union Anton abt 32k blt 2010 Hakodate was reported at USD 8.3 mln always to Greeks. In the tanker sector, two vintage MR has been reported sold Undine abt 45k blt 2004 Iwagi and Mermaid abt 45k blt 2004 Minaminippon (BWTS fitted) at USD 9.75 mln and USD 8.45 mln respectively. Recently, the Ardmore Seamariner abt 46k blt 2006 Minami Nippon was reported at USD 10.3 mln”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software