Nearly 25% of US Gulf oil and gas volumes offline as Hurricane Sally nears

Shell, Chevron, Murphy Oil and other producers have begun shutting in some US Gulf offshore crude and natural gas output, while at least one refinery temporarily closed its plant, ahead of Hurricane Sally, which is expected to make landfall on the Mississippi/Alabama border late Sept. 15 or early Sept. 16.

Federal regulators said Sept. 14 that 21.39% — or 395,790 b/d — of the Gulf’s oil production was shut in thus far, while 25.28% of the natural gas output was stopped, which equates to about 685 MMcf/d, although more production shut ins could be reported on Sept. 15. A total of 150 platforms and rigs were evacuated, the US Bureau of Safety and Environmental Enforcement said.

Shell said it is curtailing oil volumes at its large Olympus, Mars and Appomattox platforms, while Chevron said it has shut production at its Blind Faith and Petronius deepwater platforms in the deepwater Gulf. Murphy confirmed it evacuated multiple platforms and took production volumes offline, but a Murphy spokeswoman would not specify which facilities were impacted.

In addition, BP has evacuated non-essential personnel from its Na Kika and Thunderhorse platforms, it said.

Sally is not expected to impact as oil operations as heavily as Hurricane Laura did at the end of August. Laura, which became a stronger hurricane and targeted southwestern Louisiana across a larger swath of the Gulf, managed to shutter nearly 85% of Gulf oil production — more than 1.5 million b/d — and 2.3 million b/d of refining capacity.

“As a precautionary measure, some drilling operations have secured wells for rigs that may potentially experience severe weather,” Shell said in a statement on Sept. 14. “Some production is being curtailed at Olympus, Mars and Appomattox to prepare for potential impacts. All personnel remain aboard our assets.”

Chevron said it has evacuated personnel from its two shut-in platforms.

Refining and terminal impacts

Phillips 66 said late Sept. 13 it is temporarily closing its 255,600 b/d Alliance Refinery in southeastern Louisiana. Shell also reportedly reduced operations at its 227,400 b/d Norco refinery in Louisiana, according to Reuters, although Shell declined to comment on the facility.

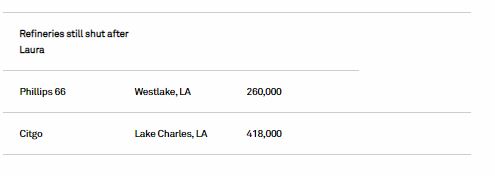

Some refining and pipeline operations remain offline from Laura, including Phillips 66’s 260,000 b/d Lake Charles refinery and Citgo Petroleum’s 418,000 b/d Lake Charles refinery. Combined, that’s more than 1 million b/d of crude refining capacity currently offline in Louisiana.

The refinery outages have boosted refined products prices on the US Gulf Coast, with diesel price differentials reaching highs last seen over six months ago.

Platts assessed ULSD on the Gulf Coast at the NYMEX October ULSD futures contract minus 3.90 cents/gal on Sept. 14, up 35 points from Sept. 11, and the highest since March 3, when it was assessed at prompt-month futures minus 3.75 cents/gal.

USGC ULSD production reached a more than 2.5-year low for the week that ended Sept. 4, falling 278,000 b/d to 2.21 million b/d, Energy Information Administration data released Sept. 10 showed.

USGC ULSD stocks fell for the second consecutive week, reaching 54.10 million barrels. However, stocks remained well above the five-year average of 40.06 million barrels, despite lower production, the EIA data showed.

Chevron also has shut in its Empire and Fourchon terminals and related pipeline systems, the company said.

“At our onshore facilities, we are following our storm preparedness procedures and are paying close attention to the forecast and track of the system,” Chevron said.

The Louisiana Offshore Oil Port also suspended operations Sept. 13 at its marine terminal.

Likewise, the Cameron Highway Oil Pipeline System, called CHOPS, has remained closed since its service was disrupted by Laura. Flows on the line, which normally deliver to end points on the Texas Gulf Coast, are being redirected to the Poseidon or Auger pipelines for transportation to locations onshore in Louisiana, a Genesis Energy spokesperson said.

CHOPS, the representative said, appears unlikely to resume normal operations before Oct. 1. An increase in Gulf of Mexico produced sour crude flows to the Louisiana area would provide more competition for Mars crude, which also delivers to end points in Louisiana, thus applying downward pressure on differentials for the grade.

Genesis said it expects to provide another update no later than Sept. 22.

Source: Platts

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software