Newbuilding Orders Pick Up Pace

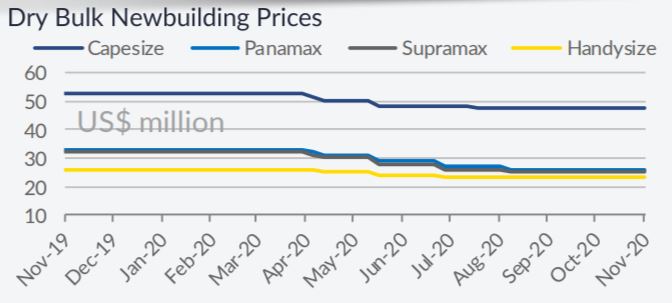

The past week was a boon for shipbuilders, as owners flocked back to yards, contracting more vessels. In its latest weekly report, shipbroker Allied Shipbroking said that it was “a very impressive week for the newbuilding market, given the plethora of fresh orders coming to light. On the dry bulk sector, despite the downward continuation in many spot freight rates, especially in the bigger size segment, things were heading in the opposite direction in terms of new ordering, with a strong number for Capesize units being placed in Chinese Shipyards. Moreover, we witnessed a strong push for Kamsarmax vessels, with the smaller sizes though, remaining relatively sluggish during the past week or so. In the tanker sector, there was a massive fresh order placing for VLCC units. This came as somewhat of a surprise, given the prolonged bearish mode from the side of freight earnings (in the whole sector). All-inall, given that we are amidst the final quarter of the year, with many being slightly in a “hurry” to finalize any pending projects, we can expect this vivid buying appetite to be sustained in the near term at least.

The past week was a boon for shipbuilders, as owners flocked back to yards, contracting more vessels. In its latest weekly report, shipbroker Allied Shipbroking said that it was “a very impressive week for the newbuilding market, given the plethora of fresh orders coming to light. On the dry bulk sector, despite the downward continuation in many spot freight rates, especially in the bigger size segment, things were heading in the opposite direction in terms of new ordering, with a strong number for Capesize units being placed in Chinese Shipyards. Moreover, we witnessed a strong push for Kamsarmax vessels, with the smaller sizes though, remaining relatively sluggish during the past week or so. In the tanker sector, there was a massive fresh order placing for VLCC units. This came as somewhat of a surprise, given the prolonged bearish mode from the side of freight earnings (in the whole sector). All-inall, given that we are amidst the final quarter of the year, with many being slightly in a “hurry” to finalize any pending projects, we can expect this vivid buying appetite to be sustained in the near term at least.

In a separate note, shipbroker Banchero Costa, “in the tanker segment Latsco placed an order for 2 x VLCC 300,000 dwt units with Daewoo: vessels to be delivered during 2nd half of 2022 and the price reported was around $89.3 mln each. Furthermore, Promag with Stena exercised one of their option at GSI Nansha for a MR tanker 49,000 dwt methanol carrier: for the first 2-3 years vessel will be trading with Stena pool. The price reported was at $46.5 mln. In the containership segment, Daewoo received an order from Zodiac Maritime for 6 x 15,000 teu container vessels with deliveries during 2022-early 2023. A joint venture between two Japanese companies Nissen Kaiun and Mitsui & co named Lepta Shipping ordered 1 + 2 optional Capesize 180,000 dwt units at Jiangsu New Yangzijiang: vessels to be delivered during end of 2022”, the shipbroker noted.

Meanwhile, in the S&P Market, Allied said that “on the dry bulk side, there was a slight slowdown in terms of activity noted during the past week, despite the fair number of fresh deals coming to light. This came hardly as a surprise, given that the excessive levels in new transactions noted these past few weeks or so aren’t supported adequately by the current state and overall sentiment in the dry market (as a whole). Notwithstanding this, given that we are amidst the final quarter of the year, it seems that we may as well experience a vivid SnP market in the near term (at least). On the tankers side, a slight step back was noted here too from the side of total volume. Especially in this particular sector, periodical fluctuations seem rather logical, given the prolonged uninspiring trajectory noted in freight earnings. With buying appetite though seemingly ample for the time being, we can expect many interesting deals to come to light before the end of the year”.

Banchero Costa added that “the TRUE DREAM 180,00 dwt built in 2014 at Tsuneishi Cebu (BWTS fitted) was finally sold: the buyer was rumoured being Great Eastern over $27 mln. The ER BORNEO 180,000 dwt built in 2010 at HHI (SS passed in 2020, scrubber fitted) was now sold for high $17 mln; remind in early October the sister built in 2010 at Daewoo Mangalia was sold for $20.75 mln. The Japanese controlled PACIFIC KINDNESS 82,000 dwt built in 2011 at Tsuneishi Zhoushan (BWTS fitted) was sold to Greek buyers for $15 mln, fairly in line with market value. Scorpio committed another modern Kamsarmax built in 2017 at Jiangnan SBI PARAPARA (scrubber fitted) to undisclosed buyers for $20.5 mln.

An interesting sale was also the APOLLO 76,000 dwt built in 2006 at Oshima (SS due Feb 2021), very high standards and conditions, forprice of $9.2 mln. 2 x Tess 58 units were sold, both BWTS fitted and built in 2010 at Tsuneishi Cebu: SEA MELODY 58,000 dwt from Santoku Senpaku was sold at high $10 mln and STOVE CALEDONIA 58,000 dwt at $11.75 mln, price inflated by the 3 years TC back at $11,000/d. The modern LENTIKIA b delta 39 design built in 2017 at Yangfan was sold to German buyers at $13.8mln. In the tanker segment, the BACALARIOS 160,000 dwt built in 2003 at Samsung (DD due June 2021) was committed to clients of Edge Maritime at $15 mln. The two years younger similar BONNY 159,000 dwt built in 2005 at HHI was sold to clients of Seven Island for $19 mln. The Greek controlled KALAMAS 105,000 dwt built in 2011 by Sumitomo (BWTS fitted) was sold to clients of Performance Shipping for $22 mln. As regards product tanker, Torm entered into an agreement with Cido for the purchase of 2 x 47,000 dwt units built in 2010 at HMD for $32 mln enbloc”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software