Second Hand Ships’ Markets in Flux as Owners Are Looking to Moderate Further Investment

Uncertainty will be the main trend in the S&P markets moving forward, as ship owners will elect to keep a conservative stance towards further boosting their fleet. In its latest weekly report, shipbroker Intermodal said that “it comes as no surprise that activity in the dry bulk SnP market remains soft, with asset values caught in the downward spiral generated by the Covid-19 shockwaves of declining demand for a number of commodities and the subsequent pressure on freight rates. Preliminary data reveals a 56% drop in the number of dry bulk second hand sales year to date, while we expect this trend to continue in the short term as the vast majority of Buyers remains reluctant to proceed decisively and invest in available candidates. The fact that the gap between their price ideas and those of the respective Sellers remains wide, together with the growing uncertainty surrounding the prospects of the sector, have pushed more investors to the sidelines at least for the time being”.

Uncertainty will be the main trend in the S&P markets moving forward, as ship owners will elect to keep a conservative stance towards further boosting their fleet. In its latest weekly report, shipbroker Intermodal said that “it comes as no surprise that activity in the dry bulk SnP market remains soft, with asset values caught in the downward spiral generated by the Covid-19 shockwaves of declining demand for a number of commodities and the subsequent pressure on freight rates. Preliminary data reveals a 56% drop in the number of dry bulk second hand sales year to date, while we expect this trend to continue in the short term as the vast majority of Buyers remains reluctant to proceed decisively and invest in available candidates. The fact that the gap between their price ideas and those of the respective Sellers remains wide, together with the growing uncertainty surrounding the prospects of the sector, have pushed more investors to the sidelines at least for the time being”.

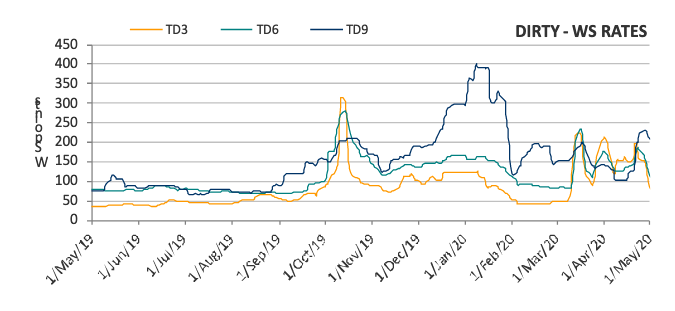

According to Mr. Vasilis Moiris, SnP Broker with Intermodal, “in total contrast with what’s been happening on the dry bulk side, activity in tanker sector remains robust, with Buyers competing intensely to secure vessels with prompt delivery in order to take advantage of the improved freight market. As a result, asset prices have been moving up quickly across the different sizes and respective age groups. The M/T Olympic Leader (309kdwt blt ’05, S. Korea) is reported sold for USD 39.2m to Greek buyers c/o Altomare, while the price includes a BWTS on order. This is the second VLCC this Buyer has been linked to, following the purchase of M/T TI Hellas (319kdwt blt ’05, S. Korea) a couple of weeks ago. In any case, the price of M/T Olympic Leader shows a further increase in values after the recent sale of M/ T Takasaki (300kdwt blt ’05, Japan) at USD 37.8m”.

Moiris added that “following last week’s Aframax sale of M/T Pallas Orust (114kdwt blt ’04, S. Korea), which was bought by Indonesians at USD 14m, the Greek controlled LR2s M/T Makronissos (106kdwt blt ’02, S. Korea) and M/T Agathonissos (106kdwt blt ’02, S. Korea) are now reported sold at region USD 13m each, which is in line with the market. In the MR segment, Monaco based buyers c/o Transocean are being linked to the acquisition of M/T Glenda Meredith (46kdwt blt ’10, S. Korea) at a rumoured price of USD 19m basis BWTS fitted. It is interesting to note that this is the first reported sale of a deepwell pump MR2 of this vintage since mid-January”.

Intermodal’s analyst also noted that “going forward, uncertainty reigns over both the dry bulk and tanker second-hand markets for different reasons. On one hand, dry bulk asset values still fail to reflect the returns in the freight market, rendering an alignment of Buyers’ and Sellers’ ideas challenging and further impeding SnP activity as a result. On the tanker side, the fact that freight rates have been moving down quickly in the past days could substantially impact the appetite of Buyers given that it was the lucrative returns that enticed them in the first place to go after prompt delivery candidates that would allow them to enjoy a quick and substantial return on their investment”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software