Tanker Market Remained Soft in September

The dirty tanker market remained soft in September amid a continued imbalance between tonnage supply and demand, keeping rates at low or even loss-making levels, OPEC said in its latest weekly report. However, there has been a definite pickup in sentiment amid hopes for a good – or certainly better – performance in the final quarter of the year. Loading schedules for both Russian and North Sea grades show noticeable increases in tonnage demand at a time of steadily higher flows from the Middle East. As a result, ship owners are reluctant to take on extended voyages at current levels heading into 4Q21 in order to not miss out when better rates finally arrive. Concerns about a shortfall in natural gas and cold for winter heating demand could also lift clean tanker rates as countries import more diesel to power small-scale generators. Looking further ahead, a sustained recovery in the tanker market could take up to 12 months to materialize to allow for both a recovery in demand from emerging and developing markets and sufficient scrapping to reduce the overhang in tonnage availability.

The dirty tanker market remained soft in September amid a continued imbalance between tonnage supply and demand, keeping rates at low or even loss-making levels, OPEC said in its latest weekly report. However, there has been a definite pickup in sentiment amid hopes for a good – or certainly better – performance in the final quarter of the year. Loading schedules for both Russian and North Sea grades show noticeable increases in tonnage demand at a time of steadily higher flows from the Middle East. As a result, ship owners are reluctant to take on extended voyages at current levels heading into 4Q21 in order to not miss out when better rates finally arrive. Concerns about a shortfall in natural gas and cold for winter heating demand could also lift clean tanker rates as countries import more diesel to power small-scale generators. Looking further ahead, a sustained recovery in the tanker market could take up to 12 months to materialize to allow for both a recovery in demand from emerging and developing markets and sufficient scrapping to reduce the overhang in tonnage availability.

Spot fixtures

Global spot fixtures fell further in September, declining by around 1.0 mb/d, or 7%, to average 13.55 mb/d. Declines came as activity in Asia had yet to take off and buying slowed in Europe. Compared to the previous year, spot fixtures were 1.4 mb/d or 9% lower.

OPEC spot fixtures also declined m-o-m in September, falling by almost 0.6 mb/d, or around 6%, to average 9.39 m/b. Compared with the same month last year, OPEC spot fixtures were about 0.5 mb/d or 5% lower. Fixtures from the Middle East-to-East saw the only positive developments in September, edging up marginally from the previous month to average just under 6.0 mb/d, amid relatively steady flows to Asia. However, the route were around 1% lower compared to the same month last year. Middle East-to-West fixtures declined by 0.2 mb/d or more than 20% m-o-m to average 700 tb/d, amid lower flows to the US. This was a decline of around 0.2 mb/d, or more than 21%, compared to the same month last year. Outside the Middle East, fixtures declined 0.4 mb/d, or 13% m-o-m, to average 2.70 mb/d in September. Y-o-y, fixtures were 7%, or around 0.2 mb/d lower.

OPEC spot fixtures also declined m-o-m in September, falling by almost 0.6 mb/d, or around 6%, to average 9.39 m/b. Compared with the same month last year, OPEC spot fixtures were about 0.5 mb/d or 5% lower. Fixtures from the Middle East-to-East saw the only positive developments in September, edging up marginally from the previous month to average just under 6.0 mb/d, amid relatively steady flows to Asia. However, the route were around 1% lower compared to the same month last year. Middle East-to-West fixtures declined by 0.2 mb/d or more than 20% m-o-m to average 700 tb/d, amid lower flows to the US. This was a decline of around 0.2 mb/d, or more than 21%, compared to the same month last year. Outside the Middle East, fixtures declined 0.4 mb/d, or 13% m-o-m, to average 2.70 mb/d in September. Y-o-y, fixtures were 7%, or around 0.2 mb/d lower.

Sailings and arrivals

OPEC sailings increased m-o-m in September, gaining around 1.1 mb/d, or around 5%, to average 22.33 mb/d. Y-o-y, OPEC sailings were 1.9 mb/d, or about 9% higher than in the same month last year. Middle East sailings continued to gain m-o-m in September, rising 0.6 mb/d, or about 4%, to average 16.5 mb/d. Y-o-y, sailings from the region rose 1.8 mb/d, or over 12%, compared with the same month last year. Crude arrivals in September declined m-o-m on all routes. Arrivals in the Far East led declines, down 0.6 mb/d or over 4% to average 13.6 mb/d. Compared with the same month last year, arrivals were sharply higher by 5.1 mb/d or 61%. Arrivals in North America averaged 8.8 mb/d last month, a decline of 0.3 mb/d, or 3% m-o-m, but 0.9 mb/d or 12% higher than the same month last year. In West Asia, arrivals slipped 0.1 mb/d, or around 2%, to average 7.1 mb/d. Y-o-y, West Asia arrivals were 2.3 mb/d, or just under 49%, higher. European arrivals remained relatively stable in September at 12.6 mb/d, down by less than 1% from the previous month but some 2.7 mb/d, or 27%, higher than the same period last year.

Dirty tanker freight rates

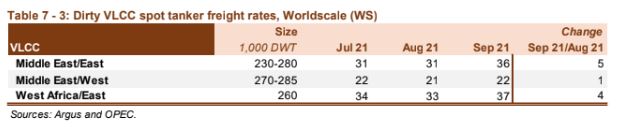

Very large crude carriers (VLCCs)

VLCC spot rates saw a welcoming increase in September, gaining 11% m-o-m, with an uptick on all major routes albeit from low summer levels and amid higher bunker costs. Y-o-y, VLCC rates showed a similar improvement of 11% with all major routes performing better. Rates on the Middle East-to-East route rose 16% m-o-m to average WS36 points, amid a general uptick in eastward activity for the vessel class. Y-o-y, rates were 20% higher. Rates on the Middle East-to-West route regained the previous month’s losses, gaining 5% in September to stand at WS22 points, amid steady flows to the US. Y-o-y, rates were 10% higher. The West Africa-to-East route also improved, up 12% m-o-m in September to average WS37 as improving flows to China offset declines elsewhere in the region. Rates were 9% higher compared with September 2020.

Suezmax

Suezmax rates experienced m-o-m gains in September, rising 9%, picking up from low levels on most routes. Rates were 45% higher compared to the same month last year. On the West Africa-to-USGC route, rates fell m-o-m to average WS48, representing a drop of 4% compared to the month before as flows were impacted by weather-related disruptions in the Gulf of Mexico. However, rates were 55% higher than in September 2020. Meanwhile, spot freight rates on the USGC-to-Europe route jumped 29% m-o-m to average WS49 points, on higher flows into the Netherlands. This was a 36% gain compared to the same month last year.

Aframax

Aframax rates continued the previous month’s gains, increasing 3% m-o-m on average, supported by weather disruptions in the Gulf of Mexico which impacted activities. Y-o-y, rates were 55% higher. The Indonesia-to-East route fell back from the previous month’s strong performance, declining 11% m-o-m to average WS89, which was still 29% higher than in the same month last year. In contrast, the Caribbeanto-USEC route improved in September, rising 27% m-o-m to average WS105, while rates were 88% higher y-o-y.

Med routes experienced marginal gains September. The Cross-Med route averaged WS89 in September, representing an increase of 3% compared with the previous month. Y-o-y, however, rates were 56% higher. On the Mediterranean-to-NWE route, rates were marginally higher m-o-m at WS80. Compared with the same month last year, rates on the route were 54% higher.

Med routes experienced marginal gains September. The Cross-Med route averaged WS89 in September, representing an increase of 3% compared with the previous month. Y-o-y, however, rates were 56% higher. On the Mediterranean-to-NWE route, rates were marginally higher m-o-m at WS80. Compared with the same month last year, rates on the route were 54% higher.

Clean tanker freight rates

Average clean spot freight rates in September gave up some of the gains enjoyed in the previous month, slipping 5% m-o-m. A decline was seen in both East and West of Suez rates, with the winding down of the driving season in the Norther Hemisphere and the winter demand yet to kick contributing to a seasonal decline. Rates in the west were 6% lower compared to both the previous month and previous year, while East of Suez rates fell 4% m-o-m but were 68% higher y-o-y.

In the East of Suez, the Middle East-to-East route declined 7% to average WS114, but were 58% higher y-o-y. Freight rates on the Singapore-to-East route declined 2% m-o-m to average WS155. Rates were 74% higher compared with September 2020. In the West of Suez market, rates on the NWE-to-USEC route declined 13% m-o-m, averaging WS102 points. However, rates were 3% higher compared with the same month last year. Rates on the Cross-Med and Med-to-NWE routes declined by 1% and 3% respectively to average WS115 and WS121 points. Y-o-y, rates were 8% lower on the Cross-Med route and down 10% on the Med-to-NWE route.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software