More Newbuilding Orders Reported, as Greek Ship Owners Are Making Moves

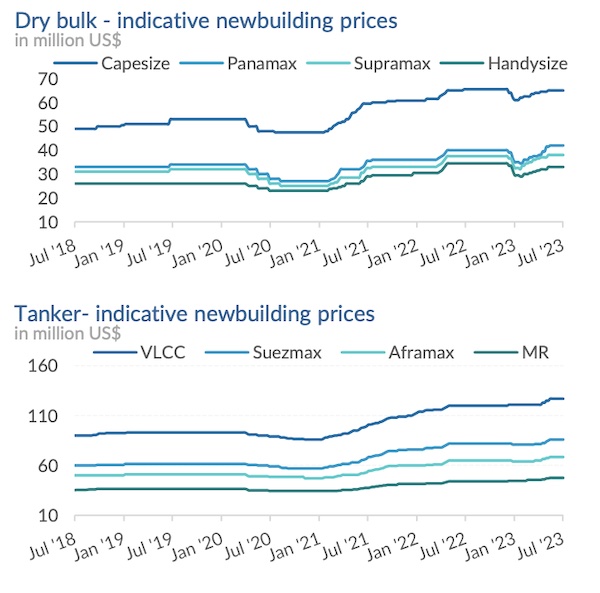

Newbuilding activity grew this past week, with more orders being reported. In its latest weekly report, shipbroker Allied said that “Dynacom’s ordering stole the show this week, as news of additional contracting came to light along with confirmation of older newbuildings placed on order. It is now established that the company has 6 VLCCS placed on order in the past two months, with the two vessels reported here previously including two optional vessels which have been declared to bring the total vessels from New Times to four. Procopiou’s dry bulk arm, Sea Traders, has just signed off on 10 Kamsarmaxes from Hengli – a very substantial deal for the recently revived yard – and it is expected that there will be 8 more ordered soon from another Chinese builder. In other sectors, it was confirmed that Evergreen’s huge order for 24 16,000-teu vessels from Samsung and Nihon was split 16-8 in favour of the former. In the LPG sector, NYK continues its steady pace of ordering, picking up an eighth VLGC order at Kawasaki”.

Newbuilding activity grew this past week, with more orders being reported. In its latest weekly report, shipbroker Allied said that “Dynacom’s ordering stole the show this week, as news of additional contracting came to light along with confirmation of older newbuildings placed on order. It is now established that the company has 6 VLCCS placed on order in the past two months, with the two vessels reported here previously including two optional vessels which have been declared to bring the total vessels from New Times to four. Procopiou’s dry bulk arm, Sea Traders, has just signed off on 10 Kamsarmaxes from Hengli – a very substantial deal for the recently revived yard – and it is expected that there will be 8 more ordered soon from another Chinese builder. In other sectors, it was confirmed that Evergreen’s huge order for 24 16,000-teu vessels from Samsung and Nihon was split 16-8 in favour of the former. In the LPG sector, NYK continues its steady pace of ordering, picking up an eighth VLGC order at Kawasaki”.

Source: Allied

In a similar note this week, shipbroker Banchero Costa added that “it was again another week of intense work in the NB business. The orderbook is growing at a strong pace with records of a large number of slots being firmed in the first 6 months of the year. China is taking the lead by far and Greek owners are contributing to a vast part of the orderbook. Procopiou who was recently on the headlines for a major order of Kamsarmaxes at Hengli in China is now reported to have ordered an additional 8 large Kamsarmax of about 85,000 dwt at Huangpu shipyard at a price of about $36 mln each.

Source: Banchero Costa

Besides these dry bulk orders he also placed an order for 4 x VLCC around 320,000 dwt at New Times for a price of $115 mln each, deliveries between 2H 2026 and 1H 2027. Yasa selected Chengxi in China for an order for Product Tankers of 50,000 dwt, price and deliveries are unknown. There is a general increasing interest by Chinese shipyards to gain share in this market with Korean shipyard dominating the NB scene for several years. To conclude there were several additional orders in different sectors such as MPP heavy lift, LPG and LNG business, to proof a high demand for new tonnage and majority of these are for conventional fuelled vessels”.

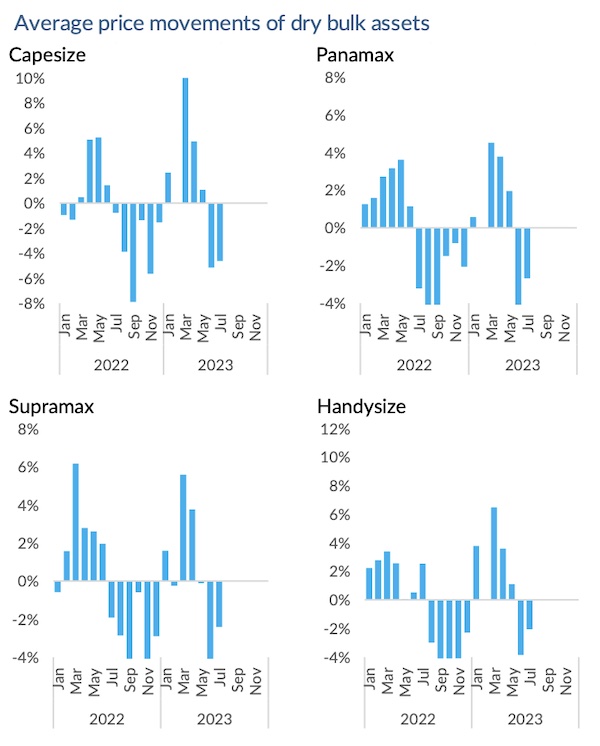

Meanwhile, in the S&P market, Allied said that “on the dry bulk side, the SnP market resumed on the slightly improved mode of late, with the number of vessels being reported as sold appearing more modest. Capesize segment retained its leading figure in terms of the past 4-week trend, on the back of the recent en-bloc deal of 5 units. On the other hand, asset prices remain under downward pressure, a situation though, that may well be translated with an improved buying appetite in the upcoming period. While entering the peak summer period, we can expect things prevail mostly sluggish. On the tanker side, the ongoing tardy phase in terms of activity taking place is slowly taking a longer term shape, a state that we can hardly escape from during the typical sluggish summer period. Asset prices will potentially play the biggest role, whether we are about to return on the strong mode of previous months”.

Source: Allied

Banchero Costa added that “a huge deal was reported in the Capesize segment: BULK INTEGRITY 175,000 dwt 2010 Jinhai, BULK ACHIEVEMENT 175,000 dwt 2011 Jinhai, BULK INGENUITY 175,000 dwt 2011 Jinhai, BULK GENIUS 175,000 dwt 2012 Jinhai, BULK JOYANCE 175,000 dwt 2012 Jinhai were reported sold by China Development Bank Leasing to Greek Owner Danaus for a price in the region of $103 mln. Sales through auctions kept flowing and the JY ATLANTIC 81,000 dwt 2019 Chengxi was sold to undisclosed buyers at $30.15 mln; it is worth mentioning that the sistership JY HONGKONG was sold on the 28th of June for $30 mln.

Source: Banchero Costa

The modern-eco Ultramax KAMBOS 63,000 dwt 2015 COSCO was reported sold at $24.65 mln. A quiet week in tanker market, with few reported sales. The most notable was the sale of DONAT 166,000 dwt 2007 Brodosplit sold in excess of $40 mln to undisclosed buyers. In the MR segment, MAGELLAN ENDEAVOUR 47,000 dwt 2006 Iwagi Zosen (DD due Jan 2024, zync coated) was sold at $17.5 mln to Chinese buyers – a one year younger Japanese vessel, the BEACON HILL 47,000 dwt 2006 Onomichi (Epoxy coated) was sold the week before at $19 mln with DD due in Jan 2025. STI VILLE 49,000 dwt 2013 Hyundai Mipo (eco engine) was sold at $32.5 mln to undisclosed buyers”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software