More Saudi Arabian crude oil exports for April, as promised

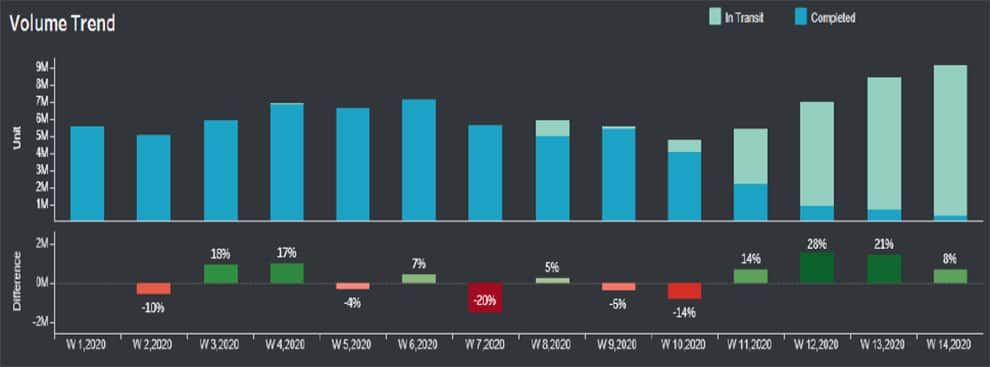

Saudi Arabia seems to be determined to follow its plan to ramp up oil exports in April, with the market already having observed a first wave of crude oil towards Europe and the US in late March. Several of the VLCCs fixed by the Kingdom in March have been loaded, allowing the country to increase exports quickly. According to IHS Markit Commodities at Sea, weekly volumes in barrels per day have been following a stable upward trend, since week 11 (starting 8th March).

Saudi Arabian crude oil liftings in barrels per day

Source: IHS Markit Commodities at Sea

Moreover, Riyadh is understood to be increasing storage of crude oil in Egypt during the last few weeks, primarily targeting the European market. Production is expected to reach 12.3 million barrels a day in April, from around 9.7 million in February. Pressure by the US to end the price war doesn’t seem to be having an effect on Saudi Arabia’s strategy so far.

The country has slashed its official selling prices, having announced an impressive increase in its output, just after Russia refused to join the OPEC+ alliance to cut output further. Meanwhile, global oil demand is set to further collapse driven by lockdowns across major oil consumers to prevent the spread of the coronavirus.

With Riyadh now opening the valves, oil shipments have been surging, with VLCC spot rates having surpassed USD 200,000 per day. Saudi Arabia was exporting close to seven million barrels a day, but current activity stands above nine million barrels a day.

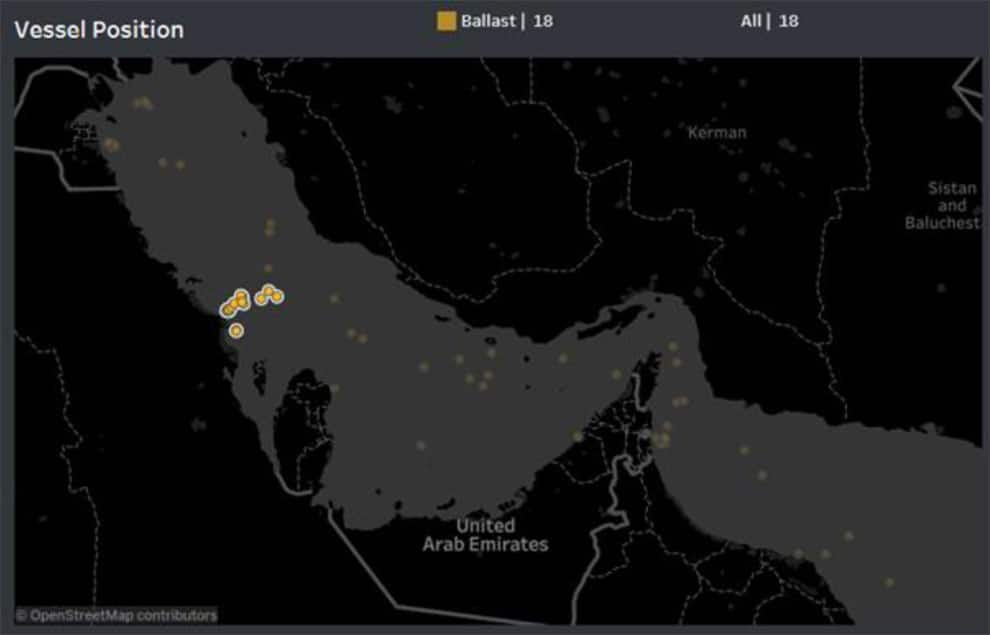

Despite the increasing diplomatic pressure, Saudi Arabia plans to export even more in the next few weeks. At least 18 ballast VLCCs are currently positioned very close to Saudi Arabia’s oil terminals of Ras Tanura and Yanbu, which could load around 36 million barrels in total, according to IHS Markit Commodities at Sea.

Number of ballast VLCCs close to Saudi Arabian terminals of Ras Tanura and Yanbu

Source: IHS Markit Commodities at Sea

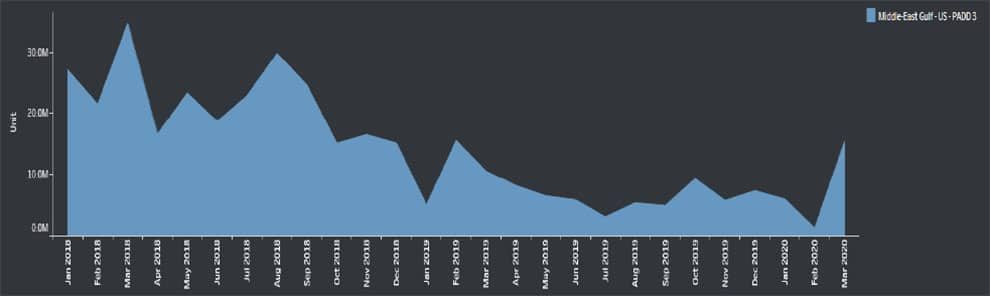

Saudi Arabia is not expected to change its policy any time soon, as cargoes have been fixed for weeks ahead. There has also been an interesting increase in shipments of cargoes heading to the USA. The TD1 route, for crude oil carried on VLCCs from the Middle East Gulf to the US, could experience a revival after experiencing a sharp decline driven by the increase of US crude oil production.

Route analysis of TD1: barrels of VLCC shipments from Middle East Gulf to US PADD 3

Source: IHS Markit Commodities at Sea

Saudi Arabia is also trying to increase its market share in the European market, recently exporting more to Egypt, with most of this cargo to be re-exported into Europe. Egypt will start being shown as one of the major destinations for Saudi Arabian exports and could potentially surpass other traditionally major importers of the country’s barrels.

Saudi Arabian crude oil barrels shipped to Egypt

Source: IHS Markit Commodities at Sea

Source: IHS Markit

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software