G10 FX Talking: Back up in short term rates is a dollar positive

EUR/USD: A dose of patience is required

• There seems to be a strong conviction out there that the dollar will weaken this year. We agree with the view but expect this story to be more evident through the second quarter – a point where short-dated US yields start to fall sharply ahead of the first Fed cut. We look for the first cut in May and 150bp of easing in all. At present, the Fed expects it will cut 75bp this year.

• Before then, the market looks to have got ahead of itself in pricing 18bp of Fed cuts at the March meeting. This looks highly unlikely and, combined with seasonal trends which support the dollar in January/February, should keep EUR/USD near 1.08/1.09.

• Far too much ECB easing is priced in as well (150bp vs. our call for 75bp). But a back-up in rates could weigh on equities and the euro.

USD/JPY: BoJ seems in no hurry to tighten policy

• USD/JPY came close to 140 in late December as the broad dollar decline and speculation over a Bank of Japan (BoJ) policy change drove sentiment. Regarding the BoJ, the mood music from Tokyo suggests no imminent changes. Wages have yet to deliver a virtuous circle for consumption and inflation and the BoJ might revise down its GDP and CPI outlook at its 23 Jan policy meeting.

• Yet we think 152 probably was the top for USD/JPY and it will struggle to hold above 146/147 levels now. Also, the better terms of trade story is providing external support for the yen.

• Two outside risks: 1) Geopolitics and a spike in oil prices are JPY negative 2) US Treasury Refunding risk on 29 Jan & higher UST yields.

GBP/USD: Loose fiscal, tight monetary could help GBP

• Sterling has been able to hold onto its late year gains pretty well and the sterling trade-weighted index is back to levels last seen in early September. The softer rate/softer dollar/higher equity environment has helped – but so has the domestic environment.

• Here, there is focus on the UK budget on 6 March, where tax cuts are on the agenda. Unlike September 2022, we believe that these are credible tax cuts funded by the lower environment for debt servicing costs. They could add 0.2-0.3% to UK GDP this year and make the case for the BoE keeping rates tighter for longer.

• A 100bp BoE easing cycle is the reason why we think GBP will be contained this year – but there are growing upside risks for GBP.

EUR/JPY: Carry trade strategies could provide support

• Carry trade strategies have probably provided some support to EUR/JPY this year. With volatility low and investors unsure of direction, the fallback has been to pursue carry. The yen still suffers from negative implied yields and unless there is a conviction call that the BoJ will exit super-loose policy, the yen will remain the preferred funding currency.

• Domestically, Japan is expected to grow a little more strongly than Europe, helped by its exposure to high end tech. And we do think the BoJ will tighten policy at the late April policy meeting.

• We have a bearish set of EUR/JPY forecasts – largely on the back of BoJ policy, but acknowledge we are fighting a three-year bull trend.

EUR/GBP: 2024 election? No problem

• Our bullish call on EUR/GBP this year is largely premised on the BoE cutting more than the ECB. Yet we may well be under-estimating sterling strength and may need to lower our EUR/GBP profile over coming months.

• UK activity might be holding up a little better than in Europe, which is seeing soft industrial production. And the UK could have some looser fiscal policy coming through too.

• We mentioned it last year but will repeat it. A UK election looks likely in October/November this year. The last two elections have seen a 5% risk premium built into the pound. But with Labour maintaining a steady 20-point lead in the polls, we see no reason for a sterling risk premium this year.

EUR/CHF: Looking for the correction higher

• EUR/CHF looks too low to us. It looks to have traded down to these 0.92/93 levels on the back of the excessive pricing of the ECB easing cycle – where at one stage nearly 200bp of 2024 ECB had been discounted. Our team looks for a mere 75bp compared to current pricing of 150bp. If we are right – and given that rate differentials have been a bigger driver over recent months – we see EUR/CHF correcting back up to the 0.95/0.96 area.

• In December, the Swiss National Bank made it clear that it had switched policy from delivering nominal CHF appreciation – this because inflation was not on target. In fact, we now expect the SNB to be FX buyers.

• Geopolitics is a bearish risk, but macro favours a higher EUR/CHF.

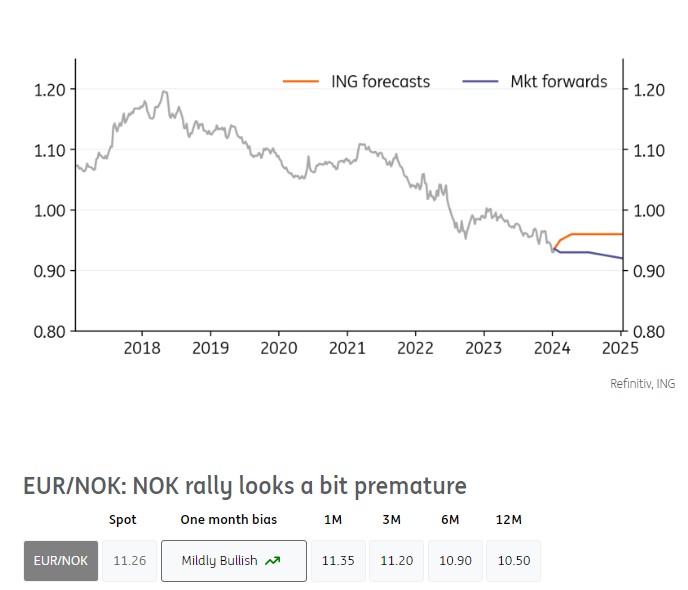

EUR/NOK: NOK rally looks a bit premature

• The surprise rate hike by Norges Bank and the risk-on rally in December gave a boost to the krone. However, we suspect NOK bulls (with whom we sympathise) may have jumped the gun.

• Norges Bank looks unlikely to hike further but shouldn’t drop its hawkish bias easily after having raised rates less than a month ago. That, however, shouldn’t be enough to keep supporting the krone near term, which is at risk of a correction as risk assets look unstable in the short-term.

• A rebound in EUR/NOK can extend to the 11.60 area in 1Q. We still favour a decline in the pair to 11.00 by the second half of the year, as the undervalued NOK benefits from lower global rates.

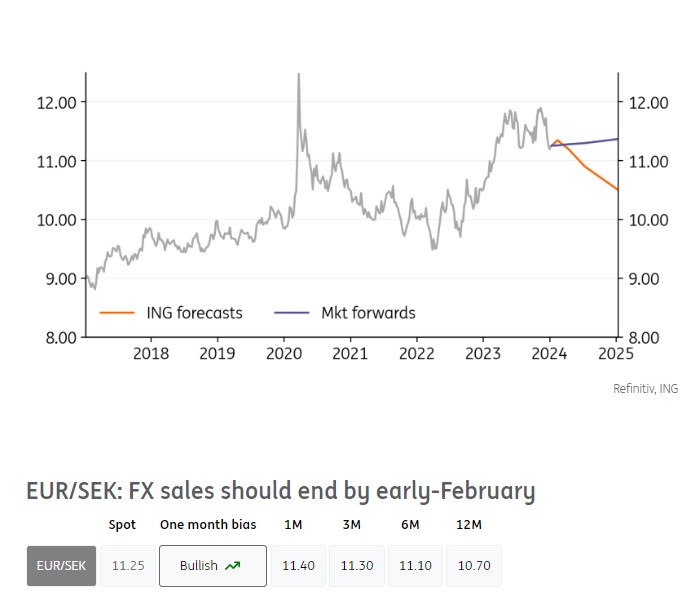

EUR/SEK: FX sales should end by early-February

• We estimate that hedging operations by the Riksbank will end by early-February. This means that the extra support for the krona (which we calculate at around 2-3% vs EUR) received by FX sales will evaporate soon.

• We do acknowledge there is a risk that the Riksbank extends FX sales, although we think the bank will prefer to observe FX and inflation dynamics first. In the event of a material SEK selloff, the chances of a new RB hedging programme would rise significantly.

• We still expect EUR/SEK to trend lower after some near-term potential upside correction. That should ultimately allow the Riksbank to turn to a more dovish stance and relieve the economy of tight rates.

EUR/DKK: Stabilisation around 7.46 to continue

• Danmarks Nationalbank did not intervene in the FX market for an eleventh straight month in November.

• FX volatility in December did not impact EUR/DKK, which has stabilised marginally below the 7.4600 central peg level. At the moment, we see no reason for DN to diverge from the ECB path in 2024. We expect 75bp of easing in both the eurozone and Denmark by the end of the year.

• DKK’s lower implied rate may gradually push EUR/DKK above the peg parity level, although not substantially. We continue to target a flat exchange rate around 7.46.

USD/CAD: BoC to follow Fed’s dovish turn

• The rebound in the dollar has taken USD/CAD back to the 1.34 mark, after a drop to the 1.32 mark in December appeared rather overdone. Incoming US data should continue to be a key driver for CAD in the crosses, given its high correlation with US economic sentiment.

• The Bank of Canada meets on 24 January, and we see a high chance that it will follow the Fed in signalling rate cuts by year-end, thus dropping its tightening bias. Governor Tiff Macklem seemed to anticipate a dovish pivot in a December speech.

• We remain unexcited about CAD’s prospects, and some benefits from residual resilience in US data may be offset by a more dovish BoC. We still favour NOK as an oil-sensitive currency in ’24.

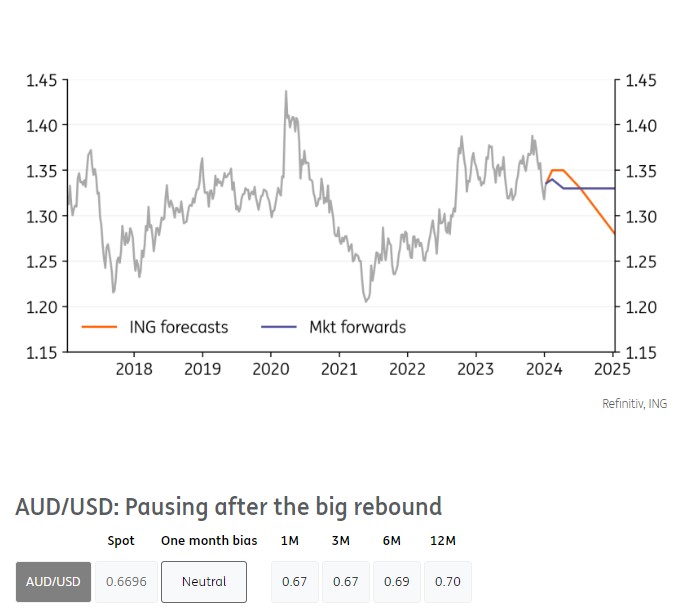

AUD/USD: Pausing after the big rebound

• We have long argued that AUD looked attractive into the new year, and surely welcome the big rally in AUD/USD in November/December. But as for the other high-beta currencies, there is probably room for some correction or at least a pause before the uptrend resumes, given unstable risk sentiment.

• Domestically, CPI was slightly lower than expected at 4.3% year-on-year in the November reading; enough to keep the Reserve Bank of Australia cautiously optimistic on the disinflation process. Still, we expect the RBA to be less dovish than the Fed this year, cutting only from 4Q.

• Policy differentials, undervaluation and lower global yields will, in our view, drive AUD/USD sustainably above 0.70 in 2H24.

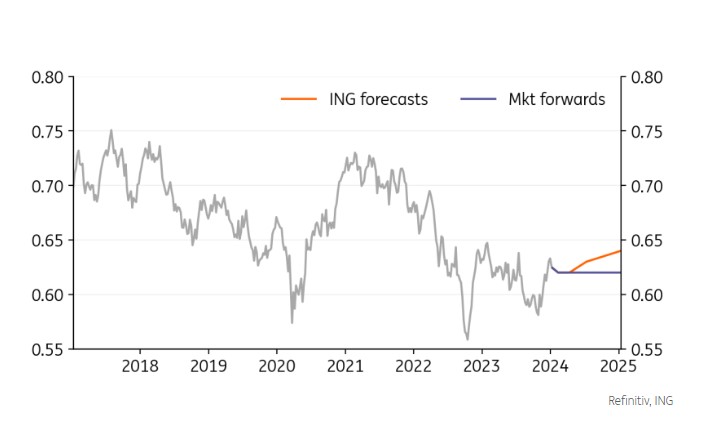

NZD/USD: Disinflation still not fast enough for the RBNZ

• The Reserve Bank of New Zealand has plenty of time to collect key data before announcing policy again on 28 February. We expect 4Q inflation to come in at around 5.0% and employment data to remain good, meaning the RBNZ may be deliver a big dovish shift as soon as February.

• NZD had a stellar year-end and remains well positioned for a rally once the Fed starts easing and risk assets start to navigate less agitated waters.

• Our short-term view on NZD/USD is in line with that of other commodity currencies, expecting some stabilisation or correction from current levels.

Source: ING

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software