G10 FX Talking: Winding up for a lower dollar

EUR/USD: The Fed is minded to cut rates

- Having been held up through the first quarter on better growth and particularly higher inflation numbers, we think dollar support now starts to fade. At its most recent press conference, Federal Reserve Chair, Jay Powell, made clear that the Fed is minded to cut rates. The Fed expects three cuts in 2024, we expect five starting in June.

- We look for the soft landing narrative to gain traction over coming months and expect a bullish steepening of the US yield curve and rate differentials moving against the dollar to see EUR/USD gently climb above the end-year consensus of 1.10.

- At the same time, we think a little too much is priced in for the European Central Bank cycle this year. We see just three cuts starting in June.

USD/JPY: BoJ bites the bullet and hikes

- The Bank of Japan has finally exited a negative rate environment and now targets policy in the 0-0.1% area. USD/JPY rallied on the announcement on the view that policy would remain accommodative. And there remain doubts that the large 4%+ wage gains negotiated by the unions are not repeated in the SME sector. Understandably the yen is favoured as a funding currency.

- Yet we think the softer dollar environment and the fact that the BoJ has started tightening now makes it harder for USD/JPY to break above 152. Locals think the BoJ will intervene at 155.

- Last November/December showed that USD/JPY could come lower on the US rate story alone. And the yen is undervalued.

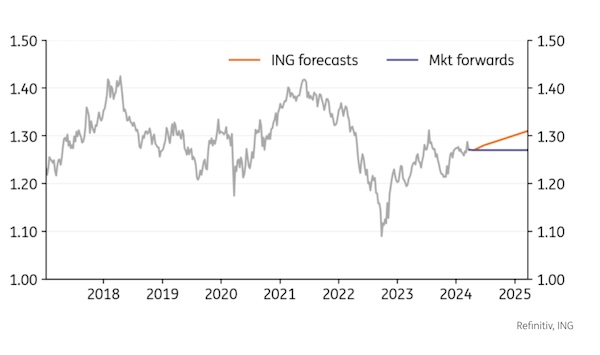

GBP/USD: BoE warms up for an easing cycle

- While UK activity is looking slightly brighter – helped by tax cuts – prices are moving in the right direction and paving the way for Bank of England easing later this year. The most recent MPC meeting saw two hawks abandon their votes for further tightening. Into the May and June meetings expect more MPC members to join the single vote for lower rates.

- Our house call is that the BoE cuts rates four times starting in August – and the case for that will only build as services inflation falls noticeably through the second quarter.

- We think the dollar trend will dominate and that GBP/USD stays bid near 1.28/1.30. Yet gains over 1.30 will be a struggle.

EUR/JPY: No sign of a trend change yet

- EUR/JPY remains buoyant as the market presumes that the BoJ will take its time over a next rate hike. Our negative profile here assumes a repeat of conditions seen through November and December last year. The yen actually outperformed the euro when the market aggressively positioned for lower US rates.

- Local press reports are speculating that the BoJ can hike again in October or even July. At least BoJ tightening is now a ‘live’ story.

- As to the ECB, we are all focused on wage data to be released in late April. Assuming this slows as expected, the ECB should be able to start its easing cycle in June. Our baseline call sees the yen more undervalued than the euro and EUR/JPY softening.

EUR/GBP: 0.85 base looking stronger post MPC meeting

- EUR/GBP is drifting away from the 0.8500 floor as the UK’s MPC edges very slowly towards an easing cycle. We doubt BoE easing speculation will reach a ‘fever pitch’ until closer to mid-May, when softer UK services inflation data is released. Hence our very modest upside call for EUR/GBP in the near term.

- Locally, speculation is building on the date of this year’s UK general election. Most reports favour the October/November window with perhaps the Tories trying to squeeze in another tax-cutting budget before then.

- We doubt the election will have a material impact on sterling since Labour is so far ahead in opinion polls – as it was in 1997.

EUR/CHF: SNB reacts to the stronger Swiss franc

- In a surprise move, the Swiss National Bank cut rates 25bp to 1.50% at its March meeting. At the heart of the story was the fact that inflation forecasts were cut substantially and are well below target over the forecast horizon. Here, the strong real CHF has been playing a role in weighing on prices and activity. This real, trade-weighted measure of the franc has risen back to 2015 highs.

- The SNB is holding the door open for another cut in June. We think a dovish SNB, plus overly aggressive pricing of the ECB cycle can see rate differentials gently carry EUR/CHF to 1.00 now.

- The SNB repeats it will be on both sides of the FX market. Data in late June may well show the SNB now having turned FX buyer.

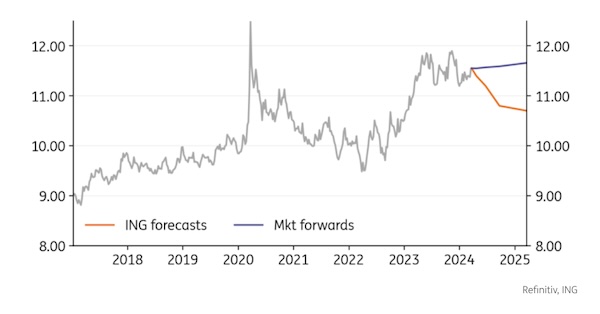

EUR/NOK: A strong outlook for the krone

- Norges Bank kept its rate projections broadly unchanged at its March meeting, and signalled rates should be kept unchanged until autumn before being gradually lowered.

That places NOK in a rather good position to rally on a decline in USD rates. The krone is undervalued, and Norges Bank has no strong domestic pressure to cut rates earlier. - Instead, policymakers appear focused on strengthening the krone.

- Our view remains unchanged for EUR/NOK: a decline from 2Q to reach 10.50 by the end of the year. We expect larger NOK gains against the dollar. Our view for global rate cuts can also favour a stable environment for oil prices.

EUR/SEK: Lower inflation opens May cut discussion

- The February CPIF report in Sweden showed encouraging signs for the Riksbank. Headline inflation declined to 2.5%, core to 3.5%. Markets are now pricing in 50-60% probability of a May cut.

- We still think the Riksbank will start easing only in June though. That is when the ECB should also deliver the first cut, and the economic picture in Sweden has improved, suggesting less urgency to trim rates.

- The risk, crucially, is that early easing would prompt a drop in the krona, which is the main concern for the Riksbank. In our view, another aggressive sell-off in the currency would be tempered by a new round of FX hedging. Anyway, SEK is (and will remain) mostly a function of USD rates dynamics, and we expect SEK strength by year-end.

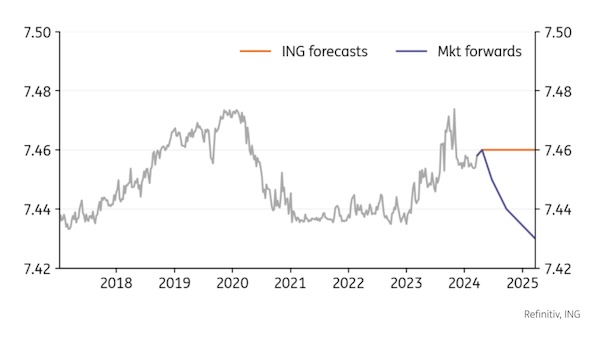

EUR/DKK: Cuts in Denmark from June

- Danmarks Nationalbank did not intervene in the FX market for a thirteenth consecutive month in February.

- EUR/DKK has found some support since early March, a welcome development by the central bank. The pair is now trading closer to the 7.4600 central peg mark.

- Corporate-related flows can steer the pair modestly in spring, but EUR/DKK is now trading at a safe distance to levels that would justify DN interventions. We continue to expect 75bp of cuts in Denmark starting from June, in line with our ECB call.

USD/CAD: Loonie less attractive than commodity peers

- Bank of Canada rate expectations remain so tightly linked to Fed pricing that developments in Canada seem to have a negligible impact on CAD. Markets are currently pricing in around 80bp of cuts by year-end both in the US and Canada.

- However, inflation in Canada undershot expectations for a second consecutive month in the February release, while the BoC has continued to shift to the dovish end of the spectrum. We think a first rate cut is due in June.

- Markets are under-pricing BoC cuts in 2024 by at least 20bp in our view and we see CAD underperforming other commodity currencies in the coming months, especially once USD rates start to decline.

AUD/USD: RBA’s half-pivot is no concern for AUD

- The Reserve Bank of Australia dropped its tightening bias at the March meeting, but very strong February employment figures make further dovish moves (e.g. introducing an outright easing bias) more difficult.

- We do not forecast more tightening by the RBA but cannot rule out an “insurance hike” in the first half of the year. Our expectations currently include 50bp of easing by year-end, starting from 3Q.

- That is broadly in line with market pricing but given our key call for larger-than-expected Fed cuts, the outlook for high-beta commodity currencies looks bright into the second half of the year. We think 0.70 is an achievable target for AUD/USD by 3Q.

NZD/USD: Migration more important than recession

- The news that New Zealand’s economy was in recession in the last two quarters of 2023 prompted speculation the RBNZ will cut rates earlier than previously expected.

- We are not convinced of this argument. The Reserve Bank of New Zealand’s remit was recently changed to focus solely on inflation, and there are still considerable upside risks to the inflation outlook due to the recent spike in net immigration in New Zealand.

- Markets have started to price in a rate cut in July, and some dovish repricing in Fed expectations could fuel some more aggressive easing expectations in the NZD curve too. For now, we think those would be misplaced, and expect cuts to start in August. NZD/USD has plenty of room to rise as USD rates decline.

Source: ING

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software