Finance M&A deals to pick up in Asia on China reopening, valuation reset

Finance sector mergers and acquisitions in Asia-Pacific could pick up in 2023 after slowing in the prior year, as potentially attractive valuations and pent-up demand in China spur dealmaking in the region.

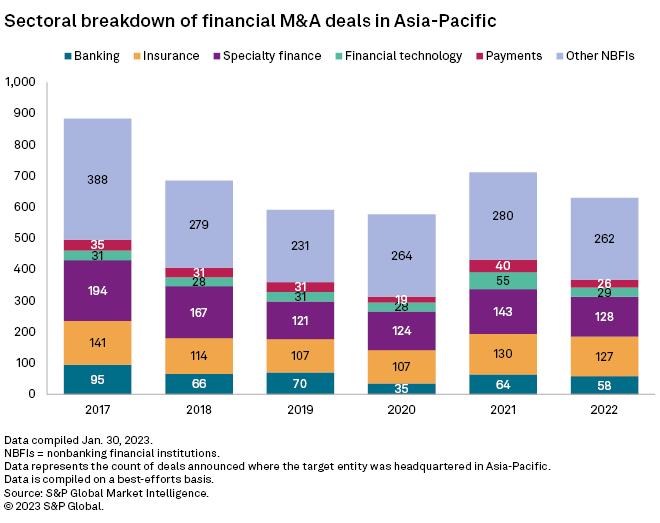

The total deal count in the region’s finance sector dropped 11.5% to 630 in 2022 from 712 in 2021, dragged by muted activity in the specialty finance, financial technology and other nonbanking financial institution areas, according to data compiled by S&P Global Market Intelligence. Geographically, mainland China and Hong Kong saw the biggest drop in deal count in the finance sector, as economic growth in the world’s second-largest economy slowed amid stricter COVID-19 restrictions.

The decline in Asia-Pacific “is very much in line with the overall M&A market. … [U]ncertainties are putting many M&A moves on hold,” said Miranda Zhao, Natixis Corporate & Investment Banking’s head of M&A for Asia-Pacific. Zhao listed inflation, rising interest rates, geopolitics and the likelihood of recession as key uncertainties. “These factors have a huge impact on buyers’ confidence and it also creates a significant valuation gap between buyers and sellers.”

Zhao expects deals in the region to pick up once the market digests the uncertainties with a reset of valuation expectations. China may see an increase in M&A activity due to pent-up demand after the recent easing of zero-COVID policy.

Investor sentiment remained skittish in 2022 as most central banks hiked interest rates to contain rising inflation, partly driven by Russia’s invasion of Ukraine. As a result, the total value of global announced M&A fell 35.8% year over year to $2.983 trillion, while the total value of global equity issuance plunged 66.6% to $351.76 billion, according to a report from Market Intelligence. The uncertainties continue to cloud the economic growth outlook, with the World Bank Group forecasting global growth to slow to 1.7% in 2023 from 2.9% in 2022, its third-weakest pace in nearly three decades.

In a Jan. 30 report, law firm White & Case said “the downward pressure on valuations observed through 2022 could help to reignite deal activity, with cash-rich buyers well-positioned to acquire high quality assets at attractive entry multiples.”

China’s reopening

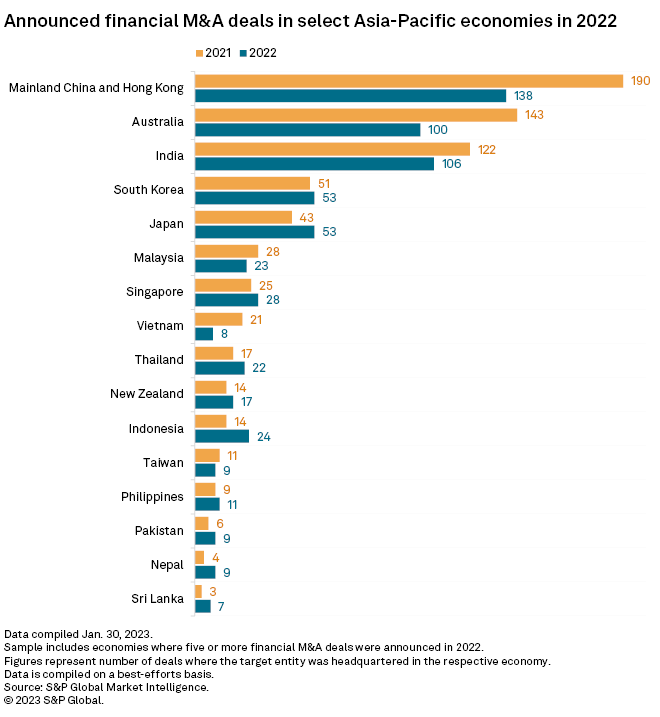

Following a marked slowdown in 2022, deal activity in China is likely to accelerate following the government’s easing of its zero-COVID policies and as expectations for the country’s economic growth improve. Finance sector deal count in mainland China and Hong Kong dropped to 138 in 2022 from 190 a year ago, according to Market Intelligence data.

“Companies are eager to explore deals both in China and abroad,” said Bagrin Angelov, managing director and head of China cross-border M&A at Chinese investment bank CICC. “Inbound investment in China will likely remain stable as it has been the case for the past decade, as global companies are extremely keen to invest in China.”

The world’s second-biggest economy struggled with slowing growth amid troubles in the real estate sector and lockdowns as part of its COVID-control policy. China’s gross domestic product grew 3% in 2022, the National Bureau of Statistics said Jan. 17. For 2023 though, the International Monetary Fund projects China’s economic growth to accelerate to 5.2%, driven by a rebound in private consumption amid the earlier-than-anticipated reopening, according to a Feb. 3 report.

“China has lifted a series of restrictions that previously restricted foreign financial institutions from entering its domestic banking, asset management and insurance fields,” said Stephen Chan, partner at Dechert LLP Hong Kong. “Such changes may contribute to greater [Asia-Pacific] M&A activities in the financial services sector in 2023.”

While China’s outbound M&A declined in 2022, inbound deal activity remained rather stable, CICC’s Angelov said, adding that multinational corporates and foreign investors invested $30 billion in China in 2022, about the average over the prior 10 years.

Green shoots, drivers

In addition to China, a more stable backdrop for interest rates and greater clarity around peak inflation would make it easier for dealmakers to establish valuations and model financial structures, helping unlock more transaction flow, White & Case said in its report.

Deals activity in the finance sector slowed markedly year over year in Australia and India as well, according to Market Intelligence data. The number of transactions in Australia dropped to 100 in 2022, from 143 in 2021, and to 106 from 122 in India.

Sector-wise, deals in the other nonbanking financial sector, which includes asset managers, financial exchanges, investment banks and brokers, dropped to 262 from 280 in 2022; to 29 from 55 in the financial technology space; and, to 128 from 143 in the specialty finance sector.

Analysts expect digitization and financial technology to be the areas to watch for more dealmaking. Factors that could drive deal activity include “digitalization, fintech, AI, blockchain-related business upgrades in order to proactively position for the next era of competition,” Natixis’ Zhao said. In addition, more M&A activity could be expected from asset managers actively looking for more diversified investment opportunities across the globe, Zhao added.

Dechert’s Chan said drivers that may drive Asia-Pacific M&A activities in 2023 are digitalization and technology; environmental, social and governance; and distressed M&A.

“The pandemic has accelerated the receptiveness of digitalized financial services in the corporate and consumer markets,” Chan said. “Technology was one of the most desirable sectors in [Asia-Pacific] cross-sector deals in 2022. Technology capabilities remain pivotal to corporate strategies in order to build market position and we expect a similar trend for the remaining of 2023.”

Source: Platts

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

Hellenic Shipping News Worldwide Hellenic Shipping News Worldwide, Online Daily Newspaper on Hellenic and International Shipping

PG-Software

PG-Software